There’s now a new way of clearing cheques more easily and quickly across the UK.

The Image Clearing System allows banks and building societies to exchange images of cheques instead of moving paper around the country.

This new approach means you can withdraw money much sooner.

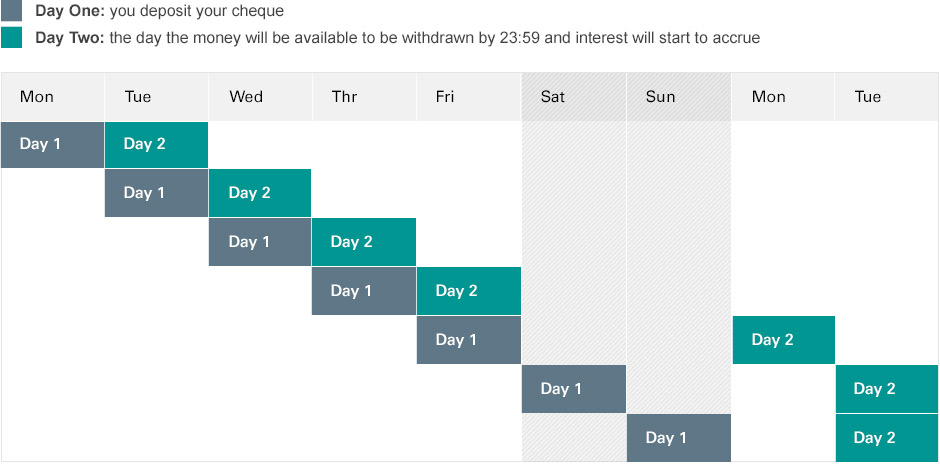

If you pay in a cheque on a weekday (before our cut-off time) you can withdraw the funds by 23:59 on the next weekday (as long as the cheque hasn’t bounced).

- Introducing mobile cheque depositYou can now pay in cheques by taking a picture using the HSBC UK Mobile Banking app.

- Paperless transactionBanks will now use images of cheques to exchange information instead of the physical paper cheques previously used.

- Faster cheque clearanceSterling cheques that are imaged will clear faster than they do today.

- Access funds within 2 daysThis means you’ll be able to access your funds within 2 working days instead of 6.

Ways to deposit a cheque

Mobile

You can now pay in cheques by taking a picture using the HSBC UK Mobile Banking app.

Branch

Post Office

You won’t see any change in the way you pay in a cheque.

You’ll receive the funds by 23:59 the next working day, once the cheque arrives at our processing centre. This may incur a slight delay.

Posted to HSBC

You’ll receive your funds by 23:59 the next working day, once we receive the cheque.

Important: To protect your funds, we continue to maintain our usual fraud checks.

How your bank statement has changed

Before cheque imaging, any cheque you paid into your account would show as pending until it had been cleared. This could take 2 to 6 days.

A cheque will no longer show as pending. If it doesn’t clear by 23:59 on the next working day, the cheque has been returned unpaid.

You’ll see a credit and debit cheque transaction.

You’ll also receive a letter to explain why the cheque was unpaid.

Make sure you have funds available

When you write a cheque, you need to make sure you have enough funds to cover it. Remember, the cheque could now debit your account as quickly as the next day.

If there’s not enough money to pay your cheque at the start of day, we may try to pay it again at 13.30.

If there’s still not enough money, it may be returned unpaid. This will apply to all UK sterling bank cheques.

Useful information

Clearing cycle

Cheque imaging statement transactions

Paid cheques

A credit transaction will appear on the account by 23:59 on the weekday after the cheque is deposited.

Unpaid cheques

If a cheque is unpaid, credit and debit transactions will show on the account by 23:59 on the weekday after the cheque is deposited. A letter will be sent giving the reason.

Re-presented cheques

If a cheque is unpaid, credit and debit transactions will show on the account by 23:59 on the weekday after the cheque is deposited. A letter will be sent advising that the cheque will be re-presented for payment.