Growing your money

HSBC Small Business Banking Account

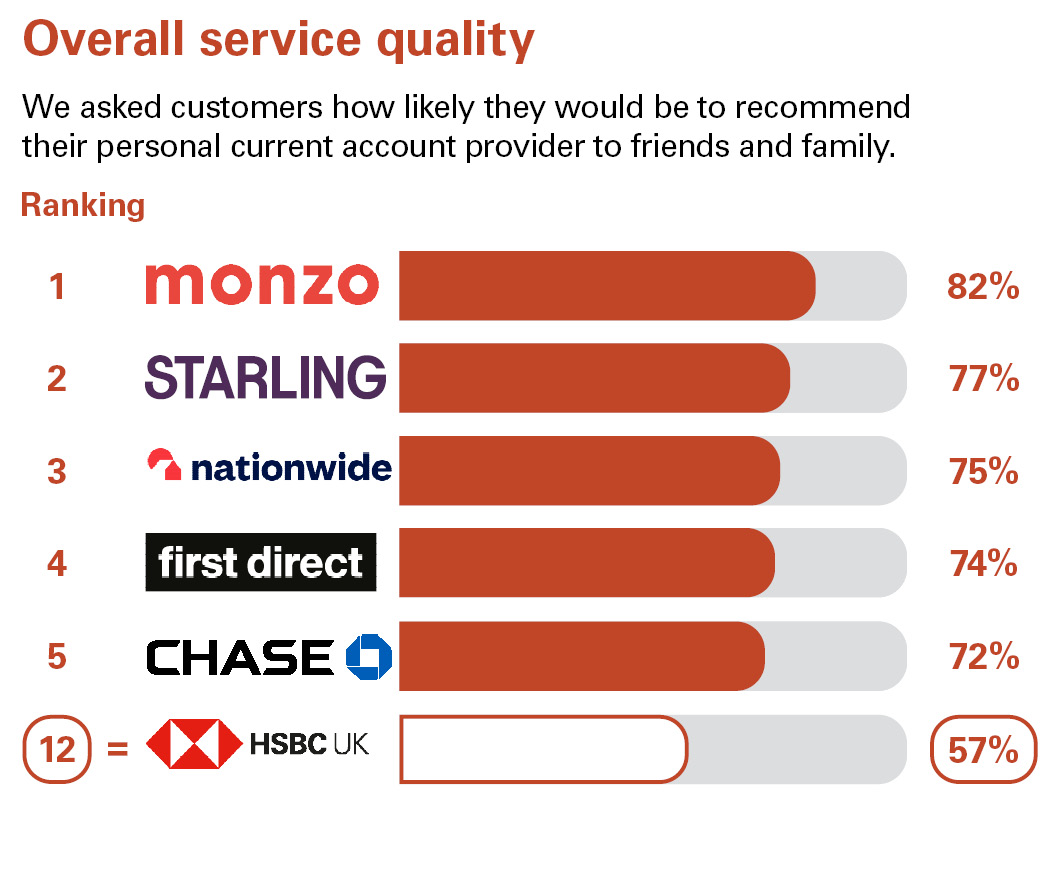

Independent service quality survey results

Personal current accounts

Great Britain

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,000 customers of each of the 17 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

Published February 2026

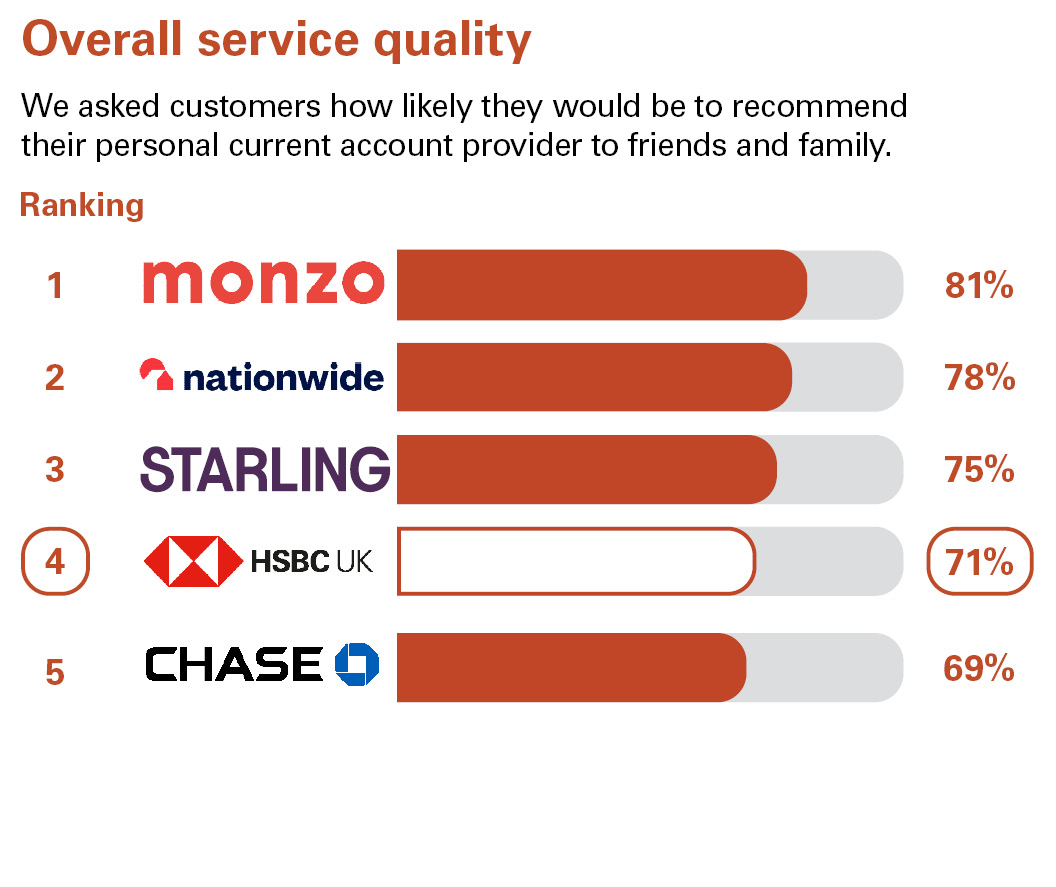

Northern Ireland

As part of a regulatory requirement, an independent survey was conducted to ask approximately 500 customers of each of the 12 largest current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

Published February 2026

The requirement to publish the Financial Conduct Authority Service Quality Information for personal current accounts can be found on the SQI page.

Authorised push payment (APP) scams rankings

Authorised push payment (APP) scams happen when someone is tricked into transferring money into a fraudster's bank account. Information about HSBC UK and first direct performance prior to the introduction of the reimbursement requirement in October 2024 can be found in the PSR's latest APP Scams Performance Report published in February 2026.

You can read the full report by visiting the PSR website.

If you are concerned about APP scams you can find out more on our APP scams page.

Your eligible deposits with HSBC UK Bank plc are protected up to a total of £120,000, or up to £240,000 for joint accounts, by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme.

This limit is applied to the total of any deposits you have with the following: HSBC UK Bank plc, HSBC Private Banking, and first direct.

Any total deposits you hold above the limit between these brands are unlikely to be covered.