Easy everyday banking for international students

If you've moved to the UK to study, this could be the account for you. It's a simple current account designed to help you do your banking with ease, with no monthly account fee. Open an account today in our app.

Features and benefits

Bank the way you want

You can manage your account with our app, on a computer, by phone or in-branch1.

Mobile payments

Make payments easily using Google Pay, Apple Pay, Samsung Pay or your contactless Visa debit card (limits may apply)2.

Limited access to credit

With this account, you won't have access to any HSBC credit cards, loans or mortgages.

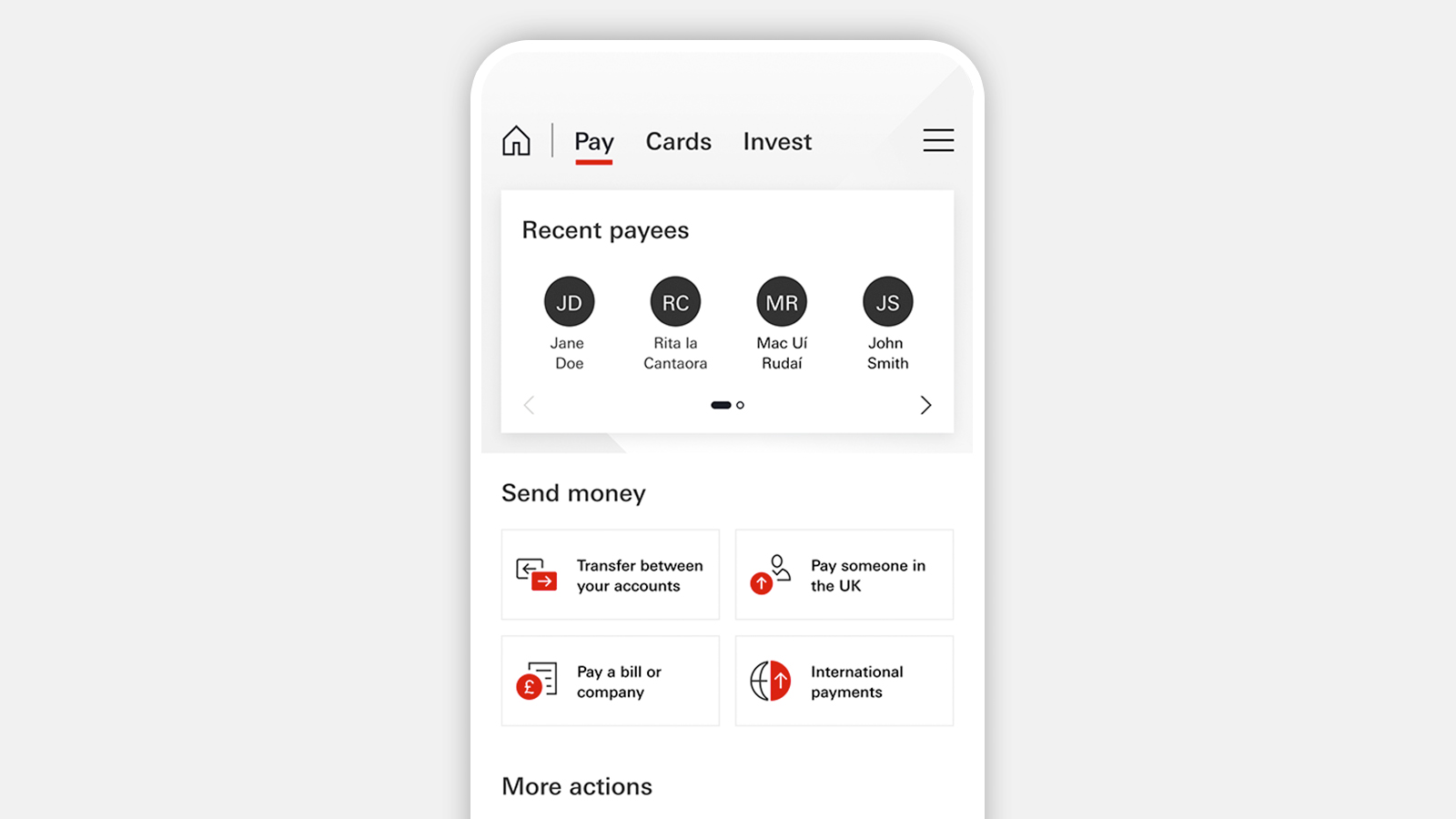

Make banking a breeze with our app

Get just about everything you want from a bank... on your phone. Check your balance, make payments, freeze your card and chat to us if you need support. All it takes is a few taps.

Understand your finances at a glance

Get an instant notification every time money goes in or out of your account3. See your spending broken down into categories and set targets to help control it with Spending insights and Monthly budgets. And use our smart tools to quickly see how much you'll have left after taking care of bills and other essentials.

Get a little more from your money

- Get discounts with our home&Away offers programme

- Enjoy access to our full range of savings accounts (including some only available to HSBC current account customers)

Exclusive accommodation offers

Moving abroad to a new place can be exciting, but also stressful at the same time. Access exclusive offers from our accommodation partners to help you or your family settle into a new life studying abroad.

- CBRE helps international students and their families looking to rent in the UK, offering a wide range of student rental properties in London and other key UK cities. Through our partnership, qualifying HSBC customers can enjoy exclusive offers, subject to availability. These include discounts on rents, reduced deposit options, cleaning services, and flexible tenancy arrangements.

Charges for using your card outside the UK

Planning on using your card back home? If you pay for something with your HSBC Visa debit card while you're outside the UK, you’ll be charged a 2.75% fee for making a debit card payment in a foreign currency. As an example, if you spent £100, you'd be charged a fee of £2.75.

If you withdraw money from an ATM, there’s also a fee for a cash withdrawal in foreign currency or from cash machines outside the UK of 2% (minimum £1.75, maximum £5). This is on top of the 2.75% fee above. This means if you withdrew £100, you'd be charged a total of £4.75.

Unless you choose to pay in local currency, any transactions you make will be converted into pound sterling (using the exchange rate set by Visa).

You may like to know that the HSBC Global Money account allows you to spend and send money around the world in multiple currencies, with no HSBC fees. It's available exclusively via the latest version of the HSBC Mobile Banking app, so you could benefit straight away from competitive live exchange rates. There's no extra cost to open or hold the Global Money Account so it's ready for when you need it. Other non-HSBC fees may apply. Eligible HSBC current account customers only.

Things to know before you apply

Ready to apply? Before you do, there are a couple of things you should check you're happy with.

About overdrafts

An arranged overdraft allows you to borrow money (up to an agreed limit) if there’s no money left in your account. This can be useful if you're hit with an unexpected bill, for example.

If a payment would take you past your arranged limit (or if you don’t have one), we may let you borrow using an unarranged overdraft. There's a chance that payments you try to make using an unarranged overdraft may be declined.

You can apply for an arranged overdraft once you open your account. You can ask to increase, remove or reduce your limit at any time in the HSBC Mobile Banking App, by phone or in-branch. Your new limit can't be less than what you owe.

We report account activity, including overdraft usage, to credit reference agencies. An unarranged overdraft lasting more than 30 days could have a negative impact on your credit rating.

This account comes with a £25 interest-free buffer. If you go overdrawn by more than that, you'll need to pay interest on the amount you borrow at the rate shown.

Overdrafts are designed for short-term borrowing only and are subject to status.

Overdraft text alerts

If we’ve got your mobile number, we’ll send you an SMS text alert if you’ve gone overdrawn or we know you’re about to. These alerts are designed to help you manage your overdraft usage and avoid being charged interest.

You can opt out of overdraft text alerts by calling us or asking us in-branch – but remember you’ll be opting out for all your current accounts with us. If you opt out or we don’t have an up-to-date number for you, you could end up paying interest you might otherwise have avoided.

What are the overdraft charges for this account?

Representative example: 0% EAR (variable)4 on the first £25, 39.9% EAR (variable) on anything above that, giving a representative annual percentage rate (APR) of 38.9% APR (variable)5. Based on an arranged overdraft of £1,200.

How does our overdraft compare? The representative APR shows the cost of borrowing over a year, so you can use it to compare the cost of our overdraft against other overdrafts and ways of borrowing.

The monthly cap on unarranged overdraft charges for the HSBC Bank Account is £20. Further details can be found online at our Overdrafts page.

To find out more, visit our Overdrafts page, where you can find out if you’re eligible for an arranged overdraft and use our overdraft cost calculator.

You may not be eligible for some account features if you remain resident outside the UK.

Who can apply?

You can apply for an HSBC Bank Account for international students if you:

- Are 18 or over

- Have valid ID and proof of address

- Have read the important account documents below

Apply for your HSBC Bank Account for international students

Apply for a sole account

Our current account for international students who have lived in the UK for less than 3 years.

Frequently asked questions

Your eligible deposits with HSBC UK Bank plc are protected up to a total of £120,000, or up to £240,000 for joint accounts, by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme.

This limit is applied to the total of any deposits you have with the following: HSBC UK Bank plc, HSBC Private Banking, and first direct.

Any total deposits you hold above the limit between these brands are unlikely to be covered

You might also be interested in

Student guides

Get help on everything from prepping for university to saving money as a student.

Build your financial fitness

Our financial fitness hub is the perfect place for guidance and tips on building your financial strength.

Additional information

- Find out more about the operating systems our app works on.

- Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries. Google Pay is a trademark of Google LLC. Samsung Pay is a registered trademark of Samsung Electronics Co., Ltd.

- You'll need to opt in to receive instant notifications. You can do this in our app. This feature is currently being rolled out and may not yet be available on all devices.

- EAR stands for effective annual rate. This is how all UK banks must show interest rates on their overdrafts, to make it easier for you to compare one bank’s overdraft with another. Please note that it doesn’t include any fees you might be charged in addition to interest.

- APR stands for annual percentage rate. This is the rate at which someone who is borrowing money is charged, calculated over a period of 12 months. It takes into account not just the interest, but also any other charges you may have to pay, as well as any interest-free amount.