The everyday bank account that puts you in control

With the HSBC Advance Account you get everything you need for everyday banking, plus access to a range of savings accounts and money-saving offers. And there's no monthly account fee.

- To apply, you'll need to be a UK resident, 18+ and qualify for an optional arranged overdraft of at least £1,000.

Here's what you get with your Advance Account

Access the world with HSBC Global Money

With an HSBC Advance Account you can apply for an HSBC Global Money Account, letting you convert, hold or send money in 50 currencies across 200 countries and regions worldwide with competitive exchange rates. Add your Global Money debit card to your digital wallet to start using it straight away. Global Money is only available via the HSBC app. Global Non-HSBC fees may apply. Learn more.

Access our 5.00% AER / gross Regular Saver

Start saving from just £25 a month with our Regular Saver. Save between £25 and £250 a month for a fixed 12-month term. Withdrawal restrictions apply.1

An optional arranged overdraft

You'll get a minimum arranged overdraft offer of £1,000 when you open your account. Learn more.

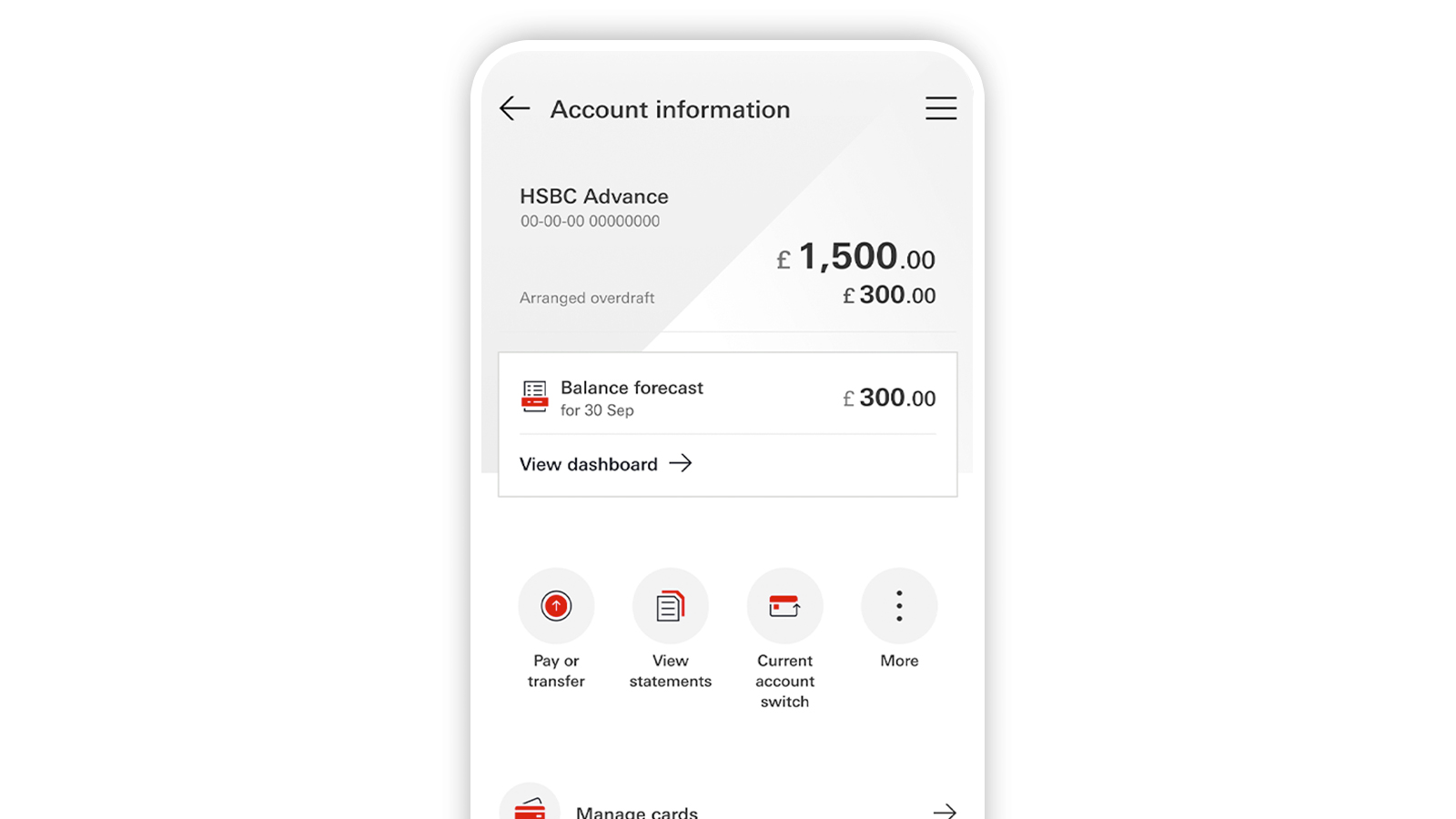

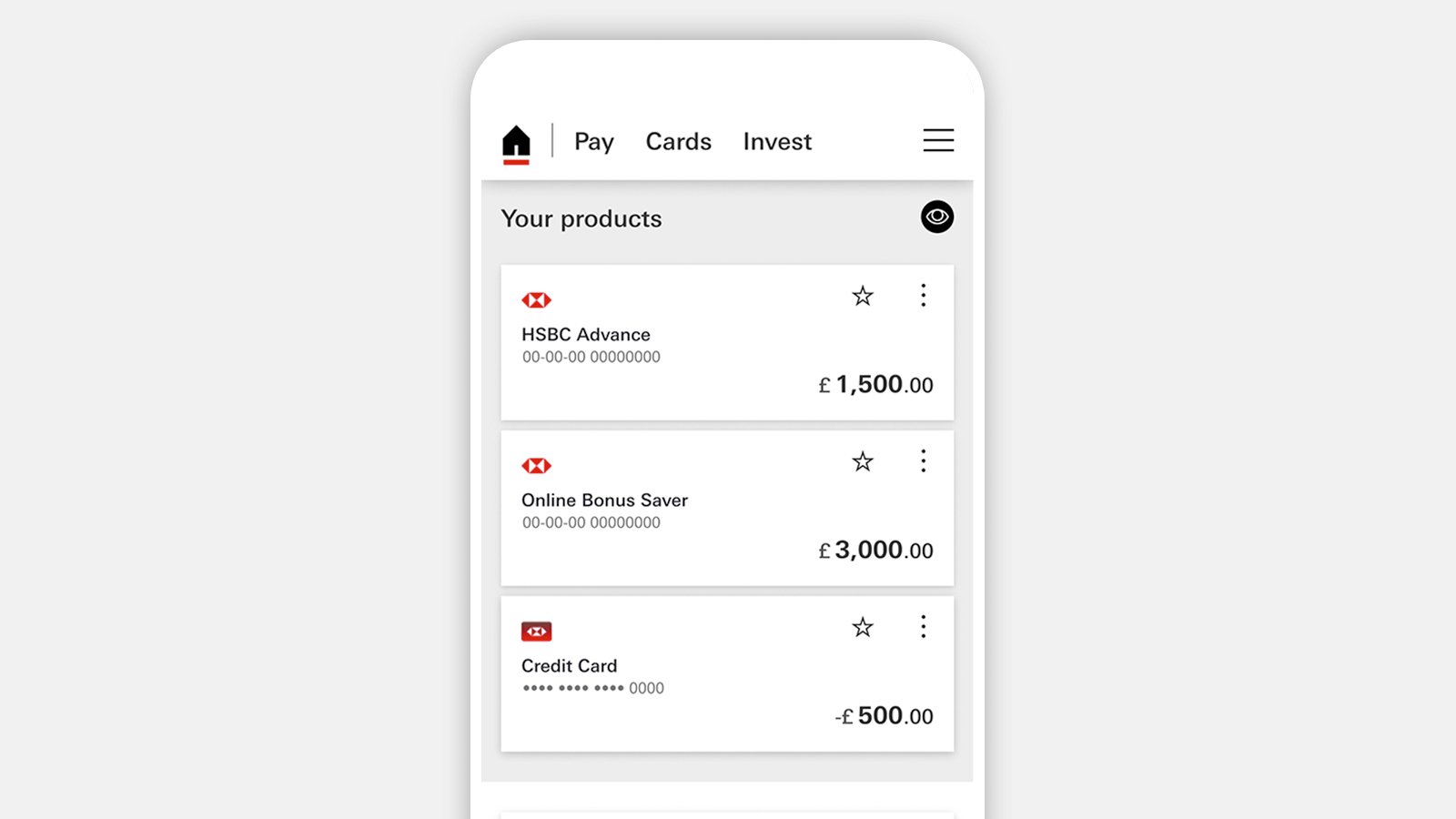

Get an app you can bank on

If you always carry your phone, you can always carry your bank. Secure, convenient and in your pocket.

- Check your balance in a flash and send money quickly and easily

- Pay in cheques just by scanning them with your phone

- See all your HSBC products in one place, including mortgages and loans

- Pay on the go with Apple Pay, Samsung Pay, Google Pay or your contactless Visa debit card. Limits may apply.2

Stay informed and in control

Our smart money tools help you keep an eye on your spending and stay on top of your finances.

- Get instant notifications when money goes in or out of your account3

- See your spending broken down into categories and set targets to help control it with Spending insights and Monthly budgets

- Budget more easily by seeing how much money you’ll have left after your bills

- Freeze your card temporarily in our app if you can't find it

- Bank online, by phone, in-branch or with our app. Whichever you prefer, we’ve got you covered.4

Enjoy a little more from your money

You’ve worked hard for your money. When you have an Advance Account, we'll help you make it go further.

- Start building your savings with our Regular Saver Account, exclusively available to HSBC current account customers

- Get discounts on shopping, dining, travel, experiences and more with our home&Away offers programme

- Withdraw up to £500 per day from cash machines

- Emergency cash transfers up to USD10,000 to any HSBC branch worldwide (funds must be available for the amount being transferred)

- Free international account opening

Things to know before you apply

Ready to apply? Before you do, there are a couple of things you should check you're happy with.

About your optional arranged overdraft

When you open this account, you'll have the option to take out an arranged overdraft.

An arranged overdraft allows you to borrow money (up to an agreed limit) if there’s no money left in your account. This can be useful if you're hit with an unexpected bill, for example.

If a payment would take you past your arranged limit (or if you don’t have one), we may let you borrow using an unarranged overdraft. There's a chance that payments you try to make using an unarranged overdraft may be declined.

You can apply for an arranged overdraft when you open your account, or at any time later. You can ask to increase, remove or reduce your limit at any time in the HSBC Mobile Banking App, by phone or in-branch. Your new limit can't be less than what you owe.

We report account activity, including overdraft usage, to credit reference agencies. An unarranged overdraft lasting more than 30 days could have a negative impact on your credit rating.

This account comes with a £25 interest-free buffer. If you go overdrawn by more than that, you'll need to pay interest on the amount you borrow at the rate shown.

Overdrafts are designed for short-term borrowing only, and are subject to status.

Overdraft text alerts

If we’ve got your mobile number, we’ll send you an SMS text alert if you’ve gone overdrawn or we know you’re about to. These alerts are designed to help you manage your overdraft usage and avoid being charged interest.

You can opt out of overdraft text alerts by calling us or asking us in-branch – but remember you’ll be opting out for all your current accounts with us. If you opt out or we don’t have an up-to-date number for you, you could end up paying interest you might otherwise have avoided.

What are the overdraft charges for this account?

Representative example: 0% EAR (variable)5 on the first £25, 39.9% EAR (variable) on anything above that, giving a representative annual percentage rate (APR) of 38.9% APR (variable)6. Based on an arranged overdraft of £1,200.

How does our overdraft compare? The representative APR shows the cost of borrowing over a year, so you can use it to compare the cost of our overdraft against other overdrafts and ways of borrowing.

The monthly cap on unarranged overdraft charges for the HSBC Advance Account is £20. Further details can be found online at our Overdrafts page.

To find out more, visit our Overdrafts page, where you can find out if you’re eligible for an arranged overdraft and use our overdraft cost calculator.

You may not be eligible for some account features if you remain resident outside the UK.

Who can apply?

You can apply for an HSBC Advance Account if you:

- Are a UK resident

- Are 18 or older

- Are happy for us to do a credit check against your name (if you live in the UK)

- Qualify for an optional arranged overdraft of at least £1,000

- Can provide ID and proof of address if needed

- Have read the important account documents below

Apply for your HSBC Advance Account now

New to HSBC?

Apply for your account online in minutes. We’re busier than usual at the moment, so it may take longer to process your application. No need to contact us – we'll be in touch soon.

Alternatively, if you prefer you can visit one of our branches and we'll help you with your application.

Already an HSBC customer?

If you're already with HSBC, please apply for your account in a branch. You'll also need to visit a branch if you'd like to upgrade or make changes to your existing account, or to open an extra account.

Frequently asked questions

Your eligible deposits with HSBC UK Bank plc are protected up to a total of £120,000, or up to £240,000 for joint accounts, by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme.

This limit is applied to the total of any deposits you have with the following: HSBC UK Bank plc, HSBC Private Banking, and first direct.

Any total deposits you hold above the limit between these brands are unlikely to be covered.

You might also be interested in

Switching to us is easy

We make switching banks simple. Make the move from your old bank to HSBC in just a few easy steps.

HSBC Bank Account

A straightforward current account, with everything you need to stay on top of your money. Financial and other eligibility criteria apply.

Premier Bank Account

The premium bank account that gives you access to preferred products, Premier specialists and exclusive benefits and rewards. Financial and other eligibility criteria apply.

The small print

1. Regular Saver interest example

- Put away between £25 and £250 a month for a fixed 12-month term. If you save £250 every month for 12 months at 5.00% AER/gross pa interest rate, you'll earn approximately £81.25 interest (gross).

- AER stands for Annual Equivalent Rate. This shows you what the rate would be if interest were paid and compounded each year. Gross is the rate of interest paid before any tax (where applicable) has been deducted. No partial withdrawals allowed. Withdrawal restrictions apply.

2. Apple Pay is a trademark of Apple Inc., registered in the US and other countries. Google Pay is a trademark of Google LLC. Samsung Pay is a registered trademark of Samsung Electronics Co., Ltd.

3. You'll need to opt in to receive instant notifications. You can do this in our app. This feature is currently being rolled out and may not yet be available on all devices.

4. Find out more about the operating systems our app works on.

5. EAR stands for effective annual rate. This is how all UK banks must show interest rates on their overdrafts, to make it easier for you to compare one bank’s overdraft with another. Please note that it doesn’t include any fees you might be charged in addition to interest.

6. APR stands for annual percentage rate. This is the rate at which someone who is borrowing money is charged, calculated over a period of 12 months. It takes into account not just the interest, but also any other charges you may have to pay, as well as any interest-free amount.