Tap into a smart way of managing your accounts

Download the app and register in minutes. Manage your accounts on the go, with access to your cards and payments at your fingertips.

Benefits of mobile banking

Our best features

Tailor the app to your needs

Set the homepage up how you want to view your account balances, investments and Balance forecast. Plus, choose the quick links you want to see that'll take you to your most used services.

Easy to explore products and services

Move between products and services with our swipe left or right feature. Plus, we've grouped together related products and features in single hubs so you can get things done in fewer taps.

Learn more about our dedicated hub pages.

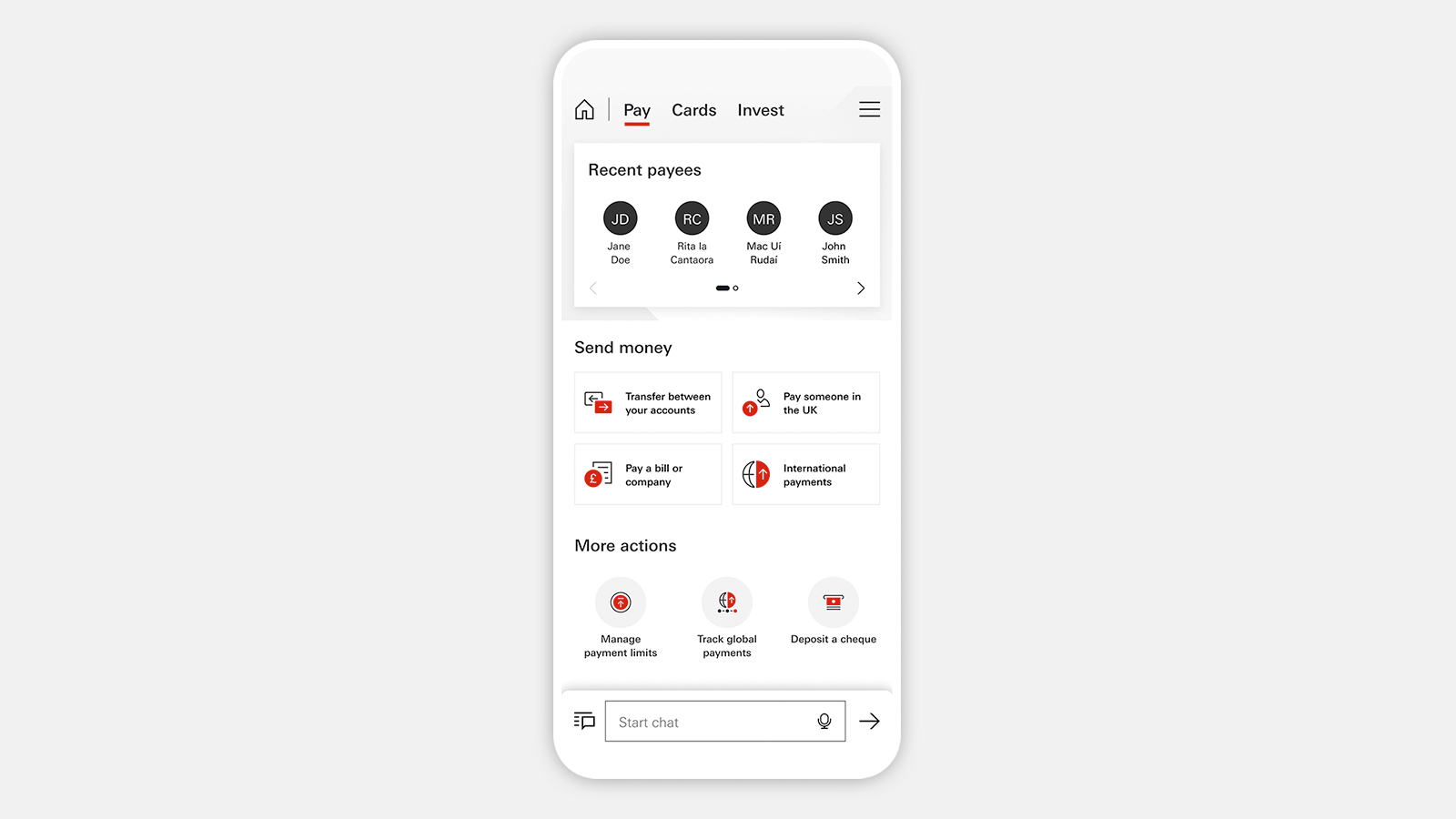

Simple payment processes

Make payments to home and existing international payees from a single hub. You can also pay your last 8 payees without re-entering their key details, and quickly access frequently used payment methods.

Always on hand to help

Get help with your banking queries easily by contacting us through the chat feature, available on every page. You can even ask for help by speaking your query.

Hub pages make tasks simpler

We've created dedicated hubs for key products and services. This means you can do all related tasks on the same page.

- Balance forecastBudget from one payday to the next with our tool. It shows your month-end balance once known standing orders and Direct Debits are deducted, and alerts you to possible shortfalls.

- CardsView and manage your credit and debit cards, apply for related products, and receive relevant offers.

- InsuranceView various insurance products and access educational articles on the importance of insurance.

- Explore productsBrowse, compare and apply for products, and get tailored product recommendations and offers.

- InvestmentsOpen one of our ready-made portfolios, or research, buy and manage 100s of funds, track your investments' performance and find further options - capital at risk.

- Security and fraudStrengthen your online security - see all the security and fraud prevention features in one easy-to-find place.

Frequently asked questions

Security is our priority

We're constantly innovating to protect you and your money. Our app has a number of safety features:

- Confirm it's you when you visit a branch or speak to us on the phone by logging on to the HSBC UK Mobile Banking app. You can also use the app to confirm you're really talking to us when you ring us.

- Get an extra layer of security when you log on using fingerprint and face recognition - available on supported devices only

- If your card is lost or stolen you can freeze it – and then unfreeze if you find it

- Keep track of money going in and out of your account with transaction notifications

- Provided you keep your security details safe, we'll refund any money taken from your account without your approval with our Digital Security Promise