Take care of your loved ones

Life insurance can help you know your loved ones are financially protected if the unexpected should happen.

If you're a Premier customer and would like to discuss ways to protect what’s important to you, you can talk to one of our financial advisers. They’ll spend time getting to know your situation, then recommend a competitive policy that's right for you from our hand-picked list of providers. To find out more about this service, including the eligibility criteria, and to book an appointment, visit protection advice.

Already have a life policy through one of our insurance providers? Find out how you can manage your policy or make a claim.

Options to consider for Life Cover

1. Level or decreasing cover

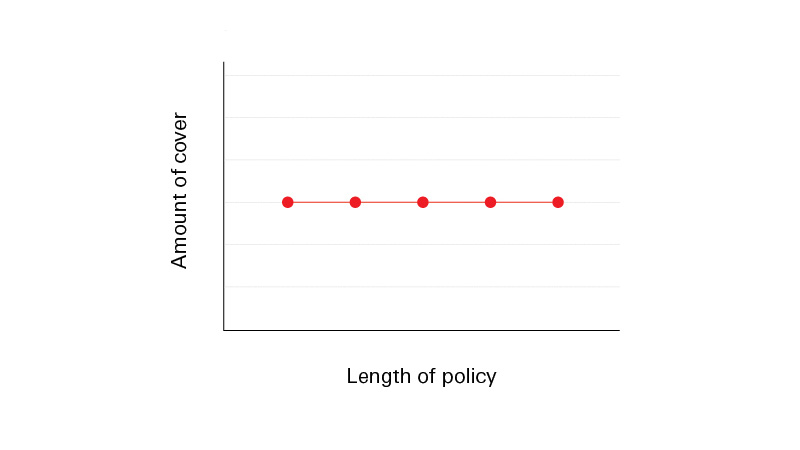

Level cover

This pays a cash lump sum that could be used to help to cover your family's living costs and/or any fixed debt like an interest-only mortgage.

The amount of cover stays the same throughout the policy

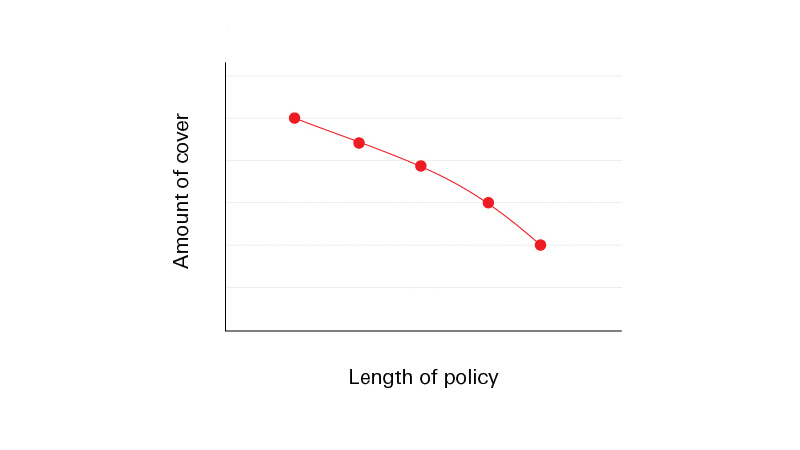

Decreasing cover

Usually a little cheaper than level cover, this type of policy is designed to cover decreasing debts, such as a capital repayment mortgage.

The amount of cover reduces over time

2. Single or joint policy

Single life policies provide cover for one person. It's tailored to the insured person's needs and pays out once when they die.

Joint life policies provide cover for 2 people. The same cover amount applies to both insured people. It pays out once when either person dies, at which point the policy ends.

Quotes are provided online for both single and joint policies.

3. Add Critical Illness Cover

With this add-on, you'd receive a lump sum on diagnosis of one of 39 illnesses and surgical procedures including, cancer (excludes less advanced cases), heart attack, stroke and dementia.

A critical illness policy payout can be used to cover bills and living costs time when you need time off work for treatment. It could also help get treated quicker through private medical care.

Frequently asked questions

You might also be interested in

Manage your policy or make a claim

Find out how to manage your life insurance policy and how to make a claim.

How much life insurance do you need?

Learn about the different types of life insurance and work out how much you might need.

What is critical illness insurance?

Find out how critical illness insurance means you know you'll be covered in the event of a diagnosis.

Should you get single or joint life insurance?

Read our simple guide to help you decide whether single or joint life insurance would be better for you.