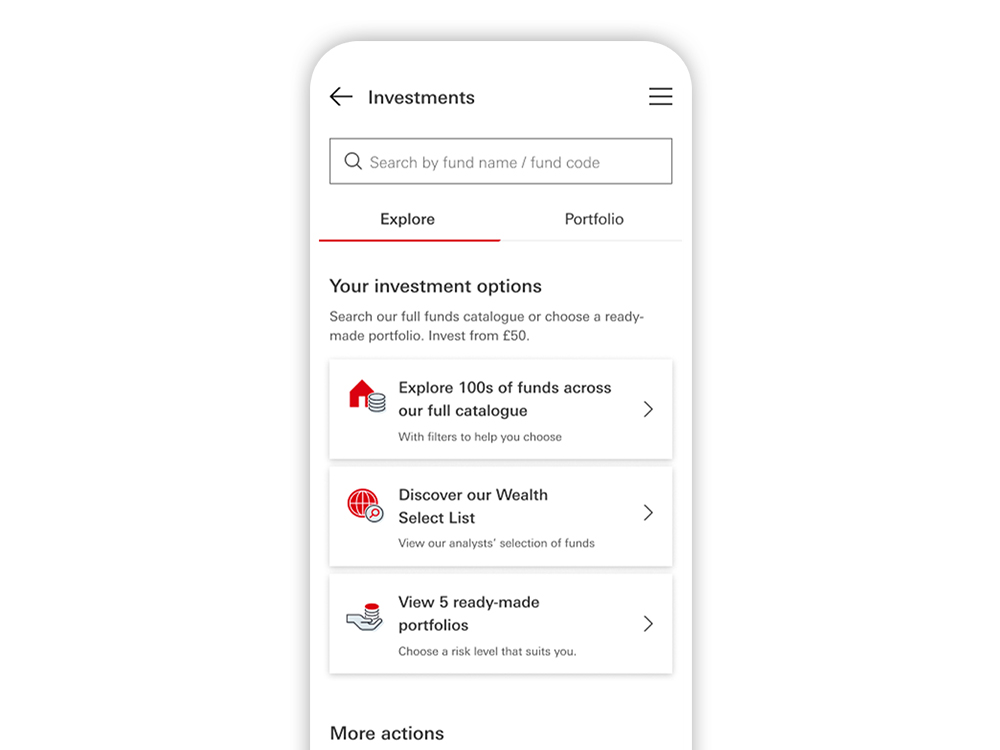

How the Wealth Select List helps you choose funds

The Wealth Select List is designed for investors who have some experience but are looking for that extra support from HSBC analysts on choosing funds. It can help you navigate a range of funds to help you build your portfolio.

Remember, investment values can go up and down. While you should aim to invest for at least 5 years, your money won't be locked away, so you can sell your investments and the money will be in your account within 5 days.

The Wealth Select List is not advice to buy or sell and past performance is not a guarantee of future performance. If you're unsure about any investment-related decision, please seek advice from a financial adviser. There may be a charge for any advice you take.

How the HSBC Wealth Select List works

The Wealth Select List includes a range of different asset classes. These are groups of investments with similar financial characteristics. Asset classes include global equities and fixed-income options among others.

Find the type of fund to suit you.

Our Wealth Select List is made up of two different types of funds. We may not reflect all asset classes in both active and tracker options at any one time.

- Active funds – led by fund managers who try to beat the market

- Tracker funds – lower-cost options that follow the market

Eligibility criteria and minimum fees apply.

Features at a glance

Additional benefits

- Our top picks to help build your portfolioWhen you invest you want well-researched options. We’ve done the hard work for you. HSBC investment analysts have compared our entire funds catalogue to bring you a curated list for you to select from.

- Carefully chosen investmentsThe Wealth Select List includes a wide range of investment types – across different countries, asset classes and investment styles. This allows you to invest in a way that works for you.

- Helps you build a diversified portfolioThe list features different types of funds to help you build a diversified portfolio. See ‘Learn more about the Wealth Select List’ to see how HSBC analysts choose the funds.

- Saves you time and effortWe’ve created this list to save you time. HSBC experts have rigorously assessed and condensed the hundreds of funds on offer across our full range into a focused list of options.

Learn more about the Wealth Select List

How we create the list

We base our selection process on these criteria:

- Qualitative assessment – we look at the firm's investment philosophy, how it operates, reputation, management team experience, investment style and process

- Performance analysis – the fund's short-term and long-term returns against its peers, benchmark (standard performance markers), as well as similar funds

- Risk profile – how volatile the fund has been over time and could be in future compared to its benchmark

- Cost assessment – the fund’s ongoing cost and transaction cost compared to its peers and the broader sector in which it sits

How we monitor and review the funds

We monitor and review the funds on the Wealth Select List to make sure each fund meets our standards and expectations. We add new funds, and if a fund no longer meets our criteria for inclusion, we’ll remove it from the list. We'll provide updates on this page.

A change to the list isn’t a recommendation to buy or sell that fund.

Who selects which funds are on the Wealth Select List?

HSBC investment analysts as part of our Group Global Managed Solutions team select which funds make it onto the list. They have devised a rigorous process to select funds based on the different factors outlined here.

HSBC Wealth Select List

Are you eligible to buy funds on the list?

To invest in any of the funds on the list you must be eligible to hold a Stocks & Shares ISA or a General Investment Account in our Global Investment Centre (GIC).

To be eligible you must:

- Be aged 18 or over

- Be a UK resident with a permanent UK residential address

- Be a UK tax resident

- Provide a valid National Insurance number, if eligible for one (if you apply to open an ISA)

- Have an HSBC current and / or savings account (excluding the Online Bonus Saver, Fixed Rate Saver and any HSBC Cash ISA).

- Not be classified as a ‘US Person’, as defined in the Global Investment Centre Terms and Conditions

If you want to discuss your eligibility, please call us on 03456 076 180.

Lines are open 08:00 to 18:00 Monday to Friday, excluding public holidays.

Ready to invest with HSBC?

Already an HSBC customer?

Open the HSBC Mobile banking app to get started.

Scan the QR code to apply in the app.

New to HSBC?

You'll need to open one of these accounts:

- An HSBC current account, or

- An HSBC savings account (excluding the Online Bonus Saver, Fixed-rate Saver and any HSBC Cash ISA)

Once your HSBC account is open, you'll be able to open a Stocks & Shares ISA or a General Investment Account.