Take care of your loved ones

What is life insurance? A life insurance policy offers financial support to your loved ones if anything were to happen to you.

It pays out a cash lump sum if you die or are diagnosed with a terminal illness. This can pay off any mortgage debt or be used towards living costs.

HSBC Life Cover is provided by HSBC Life (UK) Limited. Terms, conditions, limitations and exclusions apply.

Get a quote in minutes – or use the cover calculator to work out how much cover you may need before you apply.

Already have a life policy through one of our insurance providers? Find out how you can manage your policy or make a claim.

What you'll get with an HSBC Life Cover policy

Fixed premiums

Your premiums will never go up – and the younger you are when you take out your policy, the lower your monthly payments will be.

Lump sum payout

You or your family will get a lump sum if you die or are diagnosed with a terminal illness.

Reliable cover

HSBC Life paid over 97% of claims in 2023.

Why choose HSBC Life Cover?

- Quick quoteGet an online quote to cover just you, or you and someone else.

- Cover calculatorWork out how much cover you may need just for you.

- Choice of coverChoose from level or decreasing cover, and a single or a joint policy.

- Critical Illness Cover add-onOption to add on Critical Illness Cover for 39 conditions.

Do you need level or decreasing life insurance?

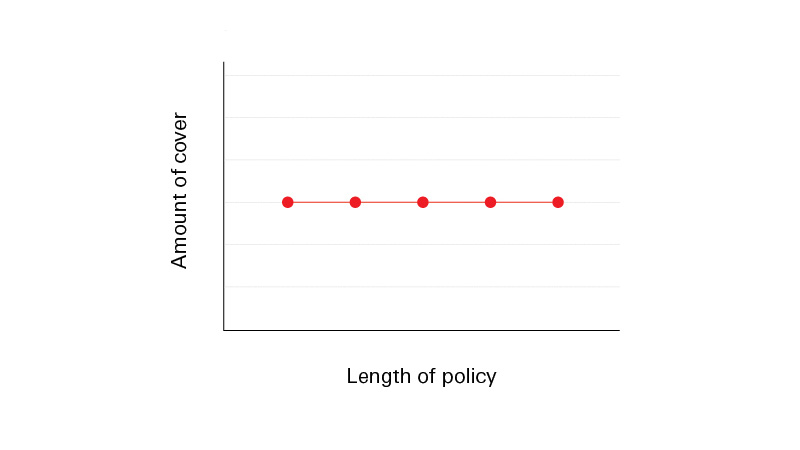

Level cover

This pays a cash lump sum that could be used to help to cover your family's living costs and/or any fixed debt like an interest-only mortgage.

The amount of cover stays the same throughout the policy

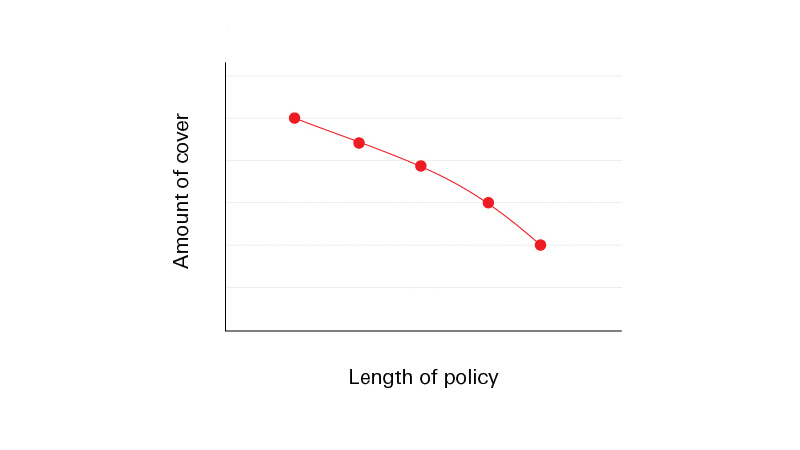

Decreasing cover

Usually a little cheaper than level cover, this type of policy is designed to cover decreasing debts, such as a capital repayment mortgage.

The amount of cover reduces over time

Other options for your HSBC Life Cover

Single or joint policy

Single life policies provide cover for one person. It's tailored to the insured person's needs and pays out once when they die.

Joint life policies provide cover for 2 people. The same cover amount applies to both insured people. It pays out once when either person dies, at which point the policy ends.

Quotes are provided online for both single and joint policies.

Add Critical Illness Cover

With this add-on, you'd receive a lump sum on diagnosis of one of 39 illnesses and surgical procedures including, cancer (excludes less advanced cases), heart attack, stroke and dementia.

A critical illness policy payout can be used to cover bills and living costs time when you need time off work for treatment. It could also help get treated quicker through private medical care.

Keep in mind, the type of Critical Illness Cover offered to you online will match what you have chosen for your Life Cover. This means that if you have chosen level cover for your Life Cover policy, you will only be offered the option to add level Critical Illness Cover. This is where the payout amount stays the same for the length of the policy.

If you have chosen decreasing Life Cover, you will only be offered the option to add decreasing Critical Illness Cover. This is where the payout amount reduces over time in line with your mortgage.

What's not covered?

HSBC Life Cover

This doesn't provide cover:

- If there are changes to your health, lifestyle or occupation – and you don't tell us about them before the policy starts

- If you were to take your own life within the first 12 months of the policy

- For death outside the policy term

HSBC Critical Illness Cover

This doesn't provide cover:

- If you should pass away within a period of 10 days from the date of diagnosis

- For full details of cover for both policies, view the policy documents

Who can apply?

You can apply for HSBC Life Cover if you're:

- A UK resident (not including the Channel Islands or the Isle of Man)

- Over 17 and under 78 years of age (cover must end before your 91st birthday)

- Registered for online or mobile banking (for joint cover, only one person needs to be registered)

Not yet registered for online banking? Register now

You can add on Critical Illness Cover if you're:

- Over 17 and under 70 years of age when the policy starts (cover must end before your 80th birthday)

Need cover after your 80th birthday? Speak to one of our protection advisers.

HSBC Life Cover is provided by HSBC Life (UK) Limited. Terms, conditions, limitations and exclusions apply.

Things to know

Get an HSBC Life Cover quote today

Get a quote in minutes – or use the cover calculator to work out how much cover you may need before you apply.

Already started an application?

Continue an application you've already started via your online banking.

Other ways to apply

Other support for your banking

To make an adjustment to any of your banking with us, tell us what support you need and we can make your banking work best for you.

This could be support for:

- How we communicate with you

- Taking control of your finances

- Third party support

- A change to your personal circumstances

Frequently asked questions

You might also be interested in

Manage your policy or make a claim

Find out how to manage your life insurance policy and how to make a claim.

How much life insurance do you need?

Learn about the different types of life insurance and work out how much you might need.

What is critical illness insurance?

Find out how critical illness insurance means you know you'll be covered in the event of a diagnosis.

Should you get single or joint life insurance?

Read our simple guide to help you decide whether single or joint life insurance would be better for you.