Get online investment advice – and help if you need it

Keen to do more with your money but not sure how to invest? HSBC My Investment is our online advice service that could make it easier to decide how to invest and help you grow your money.

Start investing with just £50 a month, a lump sum of £1,000 – or both. Simply tell us about your finances and we’ll tell you whether you're ready to invest and which HSBC investment could be right for you.

Remember, investing has its downs as well as ups – and you could get back less than you invest.

Who can apply?

You can apply for HSBC My Investment if you:

- are at least 18 years old

- have an HSBC current account and you're registered for online banking

- currently live in the UK and you're a UK resident

- aren't a US national, citizen or resident (eg a US passport or green card holder)

How HSBC My Investment could help you

- Get a personalised investment recommendation

- Find out how much investment risk you're comfortable with

- Discover which HSBC investment fund could be right for you

- Start investing with just £50 a month

- Invest online in as little as 25 minutes

Why invest with HSBC?

Like saving, investing is a way to set aside money today to use in the future. Investing with us could potentially provide higher long-term growth than leaving your money in a savings account. And, rates for savings accounts are as low as they’ve ever been. The key difference is that there are no guarantees with investing.

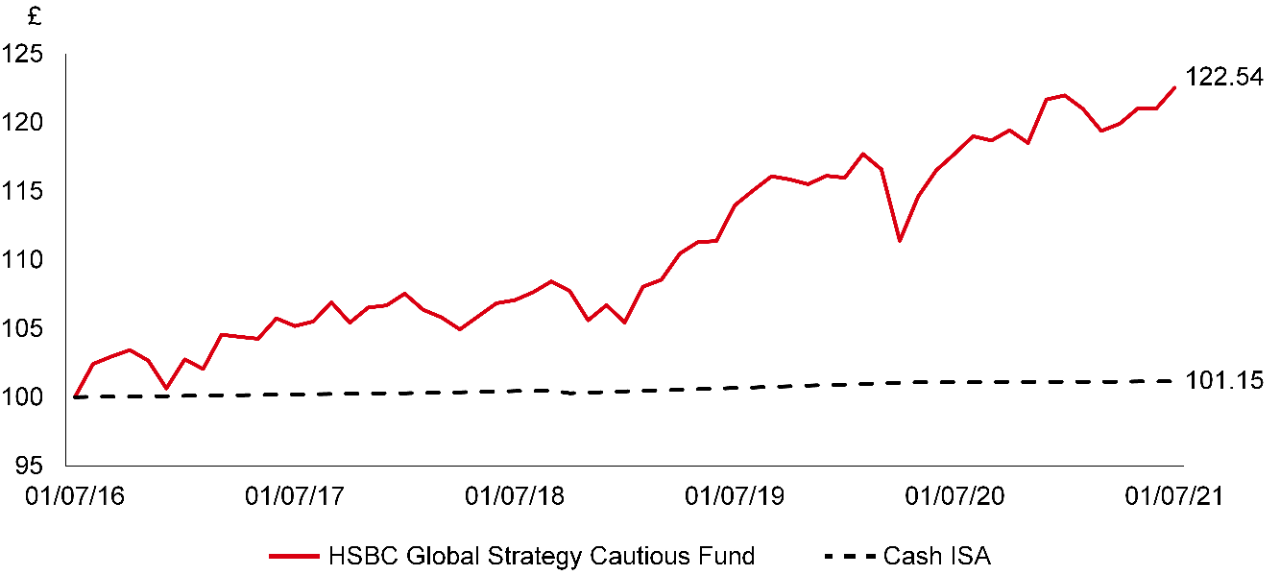

For example, we may recommend the HSBC Global Strategy Cautious Fund to you. The chart shows a greater return on £100 invested in this fund compared to the HSBC Cash ISA, this is because:

- if £100 was invested in the fund on 1 July 2016, it would have been worth £122.54 by 30 June 2021

- if £100 was put into a cash ISA, it would have only been worth £101.15

The figures and the chart refer to the past. Past performance is not a reliable indicator of future returns.

Keep in mind, investments can go down as well as up so there’s a chance you may get back less than you put in. When you invest, your money’s not locked away – you can access it at any time. But you should aim to invest for at least 5 years.

Sources: Morningstar and HSBC UK. In the fund calculations, dividends were reinvested and ongoing charges and account fees are included.

How My Investment works

Answer a few questions about your current financial situation and your future plans to work out whether you're ready to invest. Plus, find out how much you can afford to invest and how much risk you're comfortable with.

Your investment recommendation report

If investing is right for you, we'll send you a personalised investment recommendation report to your online banking. You can also access it via the HSBC Mobile Banking app.

In the report, we'll recommend an investment fund that could suit you. Our funds invest in mix of UK and overseas investments, so you can broaden your investment horizons while spreading your risk.

The funds are monitored daily by a team of professionals in HSBC Global Asset Management (UK) Limited to ensure they stay within their risk profile.

So, all you need to do is decide whether to invest and we'll do the rest for you.

My Investment is an online advice service to help you grow your money - no matter what you're saving for. If you're looking to save for your retirement, take a look at our retirement options, to make sure My Investment is the right advice service for you.

How much does it cost?

You'll only pay an advice fee if you choose to invest – and there's no obligation for you to do that.

If you decide to go ahead, you'll pay an advice fee of 0.5% of the amount you invest. If you're making monthly payments, this will be based on 12 months of contributions. So for example, if you invest £50 a month, you'll pay a one-off advice fee of just £3.

You'll also pay ongoing costs for running your investment. These will be around 0.49% a year – depending on the investment we recommend and its value at the time fees are payable. With the £50 a month example, your ongoing costs for the first year will be around £3.

If investing is right for you, we'll explain more about the charges involved to help you decide whether to invest.

Apply online

Answer some simple questions to get personalised investment advice.

If you have any questions as you apply, speak with us on chat.

We're available Monday to Friday from 08:00 to 20:00, and Saturday from 09:00 to 17:00.

Continue your application

Already started your HSBC My Investment application? Your investment advice will be valid for 14 days, so you can continue whenever you like during this time.

New to HSBC?

You'll need an HSBC current account and be registered for online banking before you can start investing with us. Take a look at our range of current accounts.

Questions you may have

You might also be interested in

A beginner's guide to investing

Demystifying investing to help you get started.

Is investing worth the risk?

Get to grips with risk and learn how it could impact your money.

The benefits of financial advice

Learn about how financial advice could help you decide what might be right for you.

Your financial action plan

4 steps to help you build a better financial future.