5 December 2025

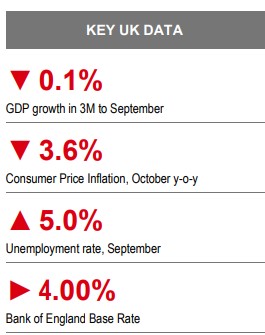

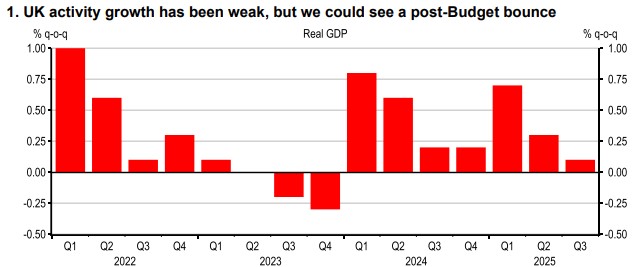

The months leading up to the UK Autumn Budget were clouded by high uncertainty and policy speculation, which appear to have contributed toa slowing in activity momentum. Indeed the PMI survey pointed to a slowing in growth in November with a notable downturn across the services sector, which reported a contraction in new order volumes. Notwithstanding that softness, against a backdrop of Budget uncertainty, activity surveys have been a less reliable signal of overall GDP growth, in fact, overestimating economic growth in Q3. The UK economy ekedout a 0.1% q-o-q expansion in the third quarter as business investment fell,and despite a small uptick in household consumption, a slowdown in government spending, which has been a driver of growth in recent quarters, weighed on overall growth.

It's possible that the economy sees a ‘bounce-back’ in the coming quarters. With the majority of fiscal tightening backdated into future years, the near-term outlook is little changed. While greater ‘headroom’ against the Chancellor’s fiscal targets shouldsee a period of greater policy certainty, if that can translate into higher confidence,then the UK could see some upside news in Q1 2026. Following the 2024 Autumn Budget and a weak H2 2024, Q1 2025 growth was robust at 0.7% q-o-q. But let’s be honest, given the low bar set in Q3 (and expected in Q4), some relatively more positive news early in 2026 shouldn’t be too difficult.

Elsewhere, a weak demand backdrop and higher unit labour costs have seen a continued softening in the labour market throughout 2025. The unemployment rate rose to 5.0% in the three months to September and more timely payroll and survey data point to further headcount reductions in Q4. Private sector pay growth slowed to 4.2% 3m/yr in September and given the slack building in the labour market, we expect more muted pay pressures into 2026. However, a further increase in the National Living Wage to around 66%of median earnings and over 70% in some regions is new territory for the UK economy, while firms’ wage growth expectations have ticked higher in recent months, to 3.8%, up from 3.5%. Whether firms respond through headcount reductions or higher inflationary pressures, both are risks for the UK economy in 2026.

From a macroeconomic perspective,there was very little in the Autumn Budget that was judged to bolster economic growth –the OBR went as far as explicitly saying so. As such, and despite higher government borrowing and expenditure in 2026, the OBR downgraded its annual 2026 GDP forecast to 1.4%.

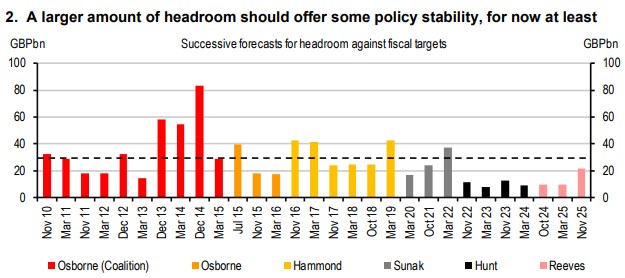

While a lack of substantial growth initiatives is a disappointment, the additional headroom against the main fiscal target to have the current budget balance in 2029/30 was welcomed. An increased margin of error from GBP9.9bn to GBP21.bn conditioned on a lower GDP growth path raises the bar for that headroom to be eroded and improves the resiliency of the UK to market or external economic shocks. Indeed, the market reactions in government bond yields and sterling have been positive.

However, the Budget did little to address the underlying challenges in UK public finances and therefore medium to longer term risks remain. Namely the prospect of further undershoots in the UK’s economic performance. Notably, despite the downgrade to productivity growth to 1.0%, the OBR remains more optimistic than other forecasters and the historical average. Moreover, with tax rises and some real-terms departmental spending cuts pencilled in for 2029/30, it raises the risk of ‘fiscal fictions’, i.e. whether those measures will be enacted when the time comes. To address those concerns, the government has announced its intention to bring forward passing legislation on some measures: at the time of writing, the cap for pension salary sacrifice at GBP2,000 appears to be the focus, alongside updated business rate valuation –both additional costs to firms in the coming years.

The following analyst(s), who is(are) primarily responsible for this document, certifies(y) that the opinion(s), views or forecasts expressed herein accurately reflect their personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report: Emma Wilks.

This document has been issued by the Research Department of HSBC.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments, both equity and debt (including derivatives) of companies covered in HSBC Research on a principal or agency basis or act as a market maker or liquidity provider in the securities/instruments mentioned in this report.

Analysts, economists, and strategists are paid in part by reference to the profitability of HSBC which includes investment banking, sales & trading, and principal trading revenues.

Whether, or in what time frame, an update of this analysis will be published is not determined in advance.

For disclosures in respect of any company mentioned in this report, please see the most recently published report on that company available at www.hsbcnet.com/research.

Additional disclosures

1. This report is dated as at 05 December 2025.

2. All market data included in this report are dated as at close 03 December 2025, unless a different date and/or a specific time of day is indicated in the report.

3. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4. You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

This document has been issued by HSBC Bank plc, which has based this document on information obtained from sources it believes to be reliable but which it has not independently verified.

Neither HSBC Bank plc nor any member of its group companies (“HSBC”) make any guarantee, representation or warranty nor accept any responsibility or liability as to the accuracy or completeness of this document and is not responsible for errors of transmission of factual or analytical data, nor is HSBC liable for damages arising out of any person’s reliance on this information. The information and opinions contained within the report are based upon publicly available information at the time of publication, represent the present judgment of HSBC and are subject to change without notice.

This document is not and should not be construed as an offer to sell or solicitation of an offer to purchase or subscribe for any investment or other investment products mentioned in it and/or to participate in any trading strategy. It does not constitute a prospectus or other offering document. Information in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on it, consider the appropriateness of the information, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice.

The decision and responsibility on whether or not to purchase, subscribe or sell (as applicable) must be taken by the investor. In no event will any member of the HSBC group be liable to the recipient for any direct or indirect or any other damages of any kind arising from or in connection with reliance on any information and materials herein. Past performance is not necessarily a guide to future performance. The value of any investment or income may go down as well as up and you may not get back the full amount invested. Where an investment is denominated in a currency other than the local currency of the recipient of the research report, changes in the exchange rates may have an adverse effect on the value, price or income of that investment. In case of investments for which there is no recognised market it may be difficult for investors to sell their investments or to obtain reliable information about its value or the extent of the risk to which it is exposed. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors.

This document is for information purposes only and may not be redistributed or passed on, directly or indirectly, to any other person, in whole or in part, for any purpose. The distribution of this document in other jurisdictions may be restricted by law, and persons into whose possession this document comes should inform themselves about, and observe, any such restrictions. By accepting this report, you agree to be bound by the foregoing instructions. If this report is received by a customer of an affiliate of HSBC, its provision to the recipient is subject to the terms of business in place between the recipient and such affiliate. The document is intended to be distributed in its entirety. Unless governing law permits otherwise, you must contact a HSBC Group member in your home jurisdiction if you wish to use HSBC Group services in effecting a transaction in any investment mentioned in this document.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document.

HSBC and/or its officers, directors and employees may have positions in any securities in companies mentioned in this document. HSBC may act as market maker or may have assumed an underwriting commitment in the securities of companies discussed in this document (or in related investments), may sell or buy securities and may also perform or seek to perform investment banking or underwriting services for or relating to those companies and may also be represented on the supervisory board or any other committee of those companies.

From time to time research analysts conduct site visits of covered issuers.

HSBC policies prohibit research analysts from accepting payment or reimbursement for travel expenses from the issuer for such visits. HSBC Bank plc is registered in England No 14259, is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority and is a member of the London Stock Exchange. (070905)

© Copyright 2025, HSBC Bank plc, ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of insert issuing entity name. MDDI (P) 005/01/2025, MDDI (P) 006/09/2024, MDDI (P) 004/10/2024, MDDI (P) 020/10/2024