Get more from your current account

Show your money who's boss by opening a new bank account. It gives you everything you need for everyday banking, including access to a range of savings accounts and money-savings offers. And there's no monthly account fee.

Open a bank account today in our app.

Here's what you get with your HSBC Bank Account

Access the world with HSBC Global Money

With an HSBC Bank Account you can apply for an HSBC Global Money Account. This lets you convert, hold or send money in 50 currencies across 200 countries and regions worldwide, with competitive exchange rates. Add your Global Money debit card to your digital wallet to start using it straight away. Global Money is only available via the HSBC app. Global non-HSBC fees may apply. Learn more

Access our 5.00% AER / gross Regular Saver

An optional arranged overdraft

You can apply for an arranged overdraft (subject to status), handy for unexpected expenses. Learn more.

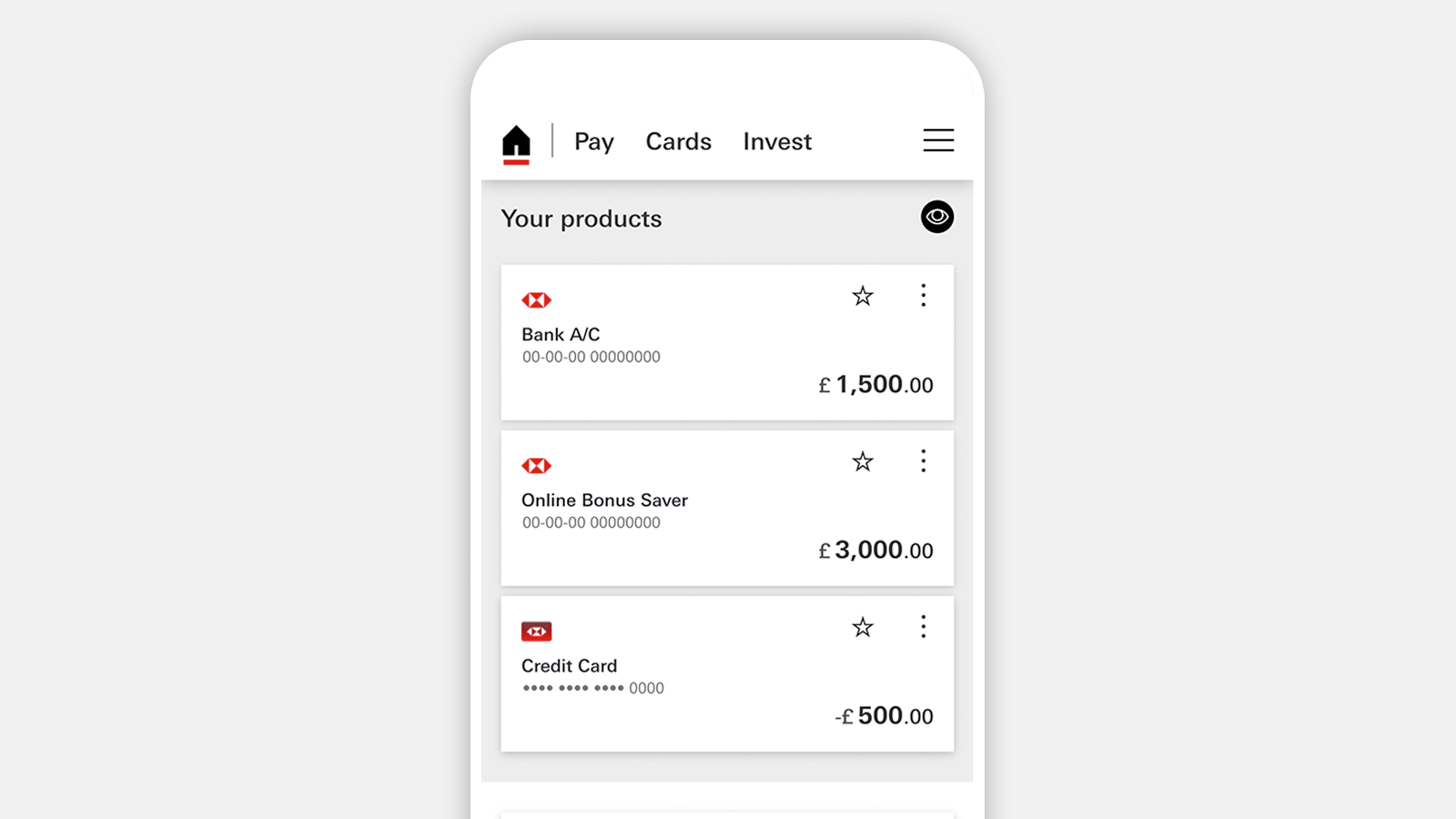

Make banking a breeze with our app

Make payments. Pay in cheques. Freeze and unfreeze your card. You can do it all in a few taps with our Mobile Banking app. You can also see any other HSBC products you have, like your mortgage or credit card, all in one secure place.

Plus pay on the go with Apple Pay, Samsung Pay, Google Pay or your contactless Visa debit card. Limits may apply.[@apple-google-samsung-pay-trademark-information]

Understand your money at a glance

Get instant notifications every time money goes in or out of your account, so you know exactly where you stand.[@mobile-notifications-opt-in] You can also see what your balance will be after bills – making budgeting much easier.

See your spending broken down into categories and set targets to help control it with Spending insights and Monthly budgets.

Freedom to bank the way you want. Online, in-app, by phone or in-branch. However you prefer to do your banking, we've got you covered.[@mobile-operating-systems]

Get more from your money

Get access to our full range of savings accounts as an HSBC current account customer including our Regular Saver and Online Bonus Saver.

Plus, enjoy discounts on shopping, dining, travel, experiences and more with our home&Away offers programme.

Things to know before you apply

Ready to apply? Before you do, there are a couple of things you should check you're happy with.

About your optional arranged overdraft

An arranged overdraft allows you to borrow money (up to an agreed limit) if there’s no money left in your account. This can be useful if you're hit with an unexpected bill, for example.

If a payment would take you past your arranged limit (or if you don’t have one), we may let you borrow using an unarranged overdraft. There's a chance that payments you try to make using an unarranged overdraft may be declined.

You can apply for an arranged overdraft when you open your account (unless you apply via the HSBC Mobile Banking app), or at any time later. You can ask to increase, remove or reduce your limit at any time in the HSBC Mobile Banking App, by phone or in-branch. Your new limit can't be less than what you owe.

We report account activity, including overdraft usage, to credit reference agencies. An unarranged overdraft lasting more than 30 days could have a negative impact on your credit rating.

This account comes with a £25 interest-free buffer. If you go overdrawn by more than that, you'll need to pay interest on the amount you borrow at the rate shown.

Overdrafts are designed for short-term borrowing only and are subject to status.

Overdraft text alerts

If we’ve got your mobile number, we’ll send you an SMS text alert if you’ve gone overdrawn or we know you’re about to. These alerts are designed to help you manage your overdraft usage and avoid being charged interest.

You can opt out of overdraft text alerts by calling us or asking us in-branch – but remember you’ll be opting out for all your current accounts with us. If you opt out or we don’t have an up-to-date number for you, you could end up paying interest you might otherwise have avoided.

What are the overdraft charges for this account?

Representative example: 0% EAR (variable)[@ear-explanation] on the first £25, 39.9% EAR (variable) on anything above that, giving a representative annual percentage rate (APR) of 38.9% APR (variable)[@apr-explanation]. Based on an arranged overdraft of £1,200.

How does our overdraft compare? The representative APR shows the cost of borrowing over a year, so you can use it to compare the cost of our overdraft against other overdrafts and ways of borrowing.

The monthly cap on unarranged overdraft charges for the HSBC Bank Account is £20. Further details can be found online at our Overdrafts page.

To find out more, visit our Overdrafts page, where you can find out if you’re eligible for an arranged overdraft and use our overdraft cost calculator.

You may not be eligible for some account features if you remain resident outside the UK.

Who can apply?

You can apply for an HSBC Bank Account if you:

- Are 18 or older

- Are happy for us to do a credit check against your name (if you're applying for a joint account and live in the UK)

- Can provide ID and proof of address if needed

- Have read the important account documents below

Not the right account for you? Find out how our Bank Account compares to other HSBC current accounts.

New to HSBC?

Want to apply for a sole Bank Account?

If you're not an existing HSBC UK customer, you can apply for a sole account in our app.

If you live in the UK you can also apply for a sole account online.

Already an HSBC UK customer?

If you're already an HSBC customer, please apply for your account in branch. You'll also need to visit us if you'd like to upgrade or make changes to your existing account, or to open an additional account.

Want to apply for a joint Bank Account?

If you're not an existing HSBC UK customer, and if you both live in the UK, you can apply for a joint account online in minutes.

Frequently asked questions

Your eligible deposits with HSBC UK Bank plc are protected up to a total of £120,000, or up to £240,000 for joint accounts, by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme.

This limit is applied to the total of any deposits you have with the following: HSBC UK Bank plc, HSBC Private Banking, and first direct.

Any total deposits you hold above the limit between these brands are unlikely to be covered.

You might also be interested in

Switching to us is easy

We make switching banks simple. Make the move from your old bank to HSBC in just a few easy steps.

Premier Bank Account

The premium bank account that gives you access to preferred products, Premier specialists and exclusive benefits and rewards.

Money worries

Concerned about your financial situation? Find out how we could help.