Just the essentials for everyday banking

Our Basic Bank Account is only for people who don’t qualify for one of our other accounts and for those who don’t already hold a payment account in the UK - perhaps because they’ve had financial trouble or have a poor credit record.

Before you can apply for a Basic Bank Account, we need to check your eligibility for our standard HSBC Bank Account first.

Here's what you get with your Basic Bank Account

A range of ways to bank

Do your banking by app, by phone, online or in our branches, making it easy to manage your account.1

Contactless payments

Make payments easily using Google Pay, Apple Pay, Samsung Pay or your contactless Visa debit card.2 Payment limits apply.

No credit or overdraft

You won't have access to credit (eg an arranged overdraft, credit cards or loans) and you won't receive a cheque book.3

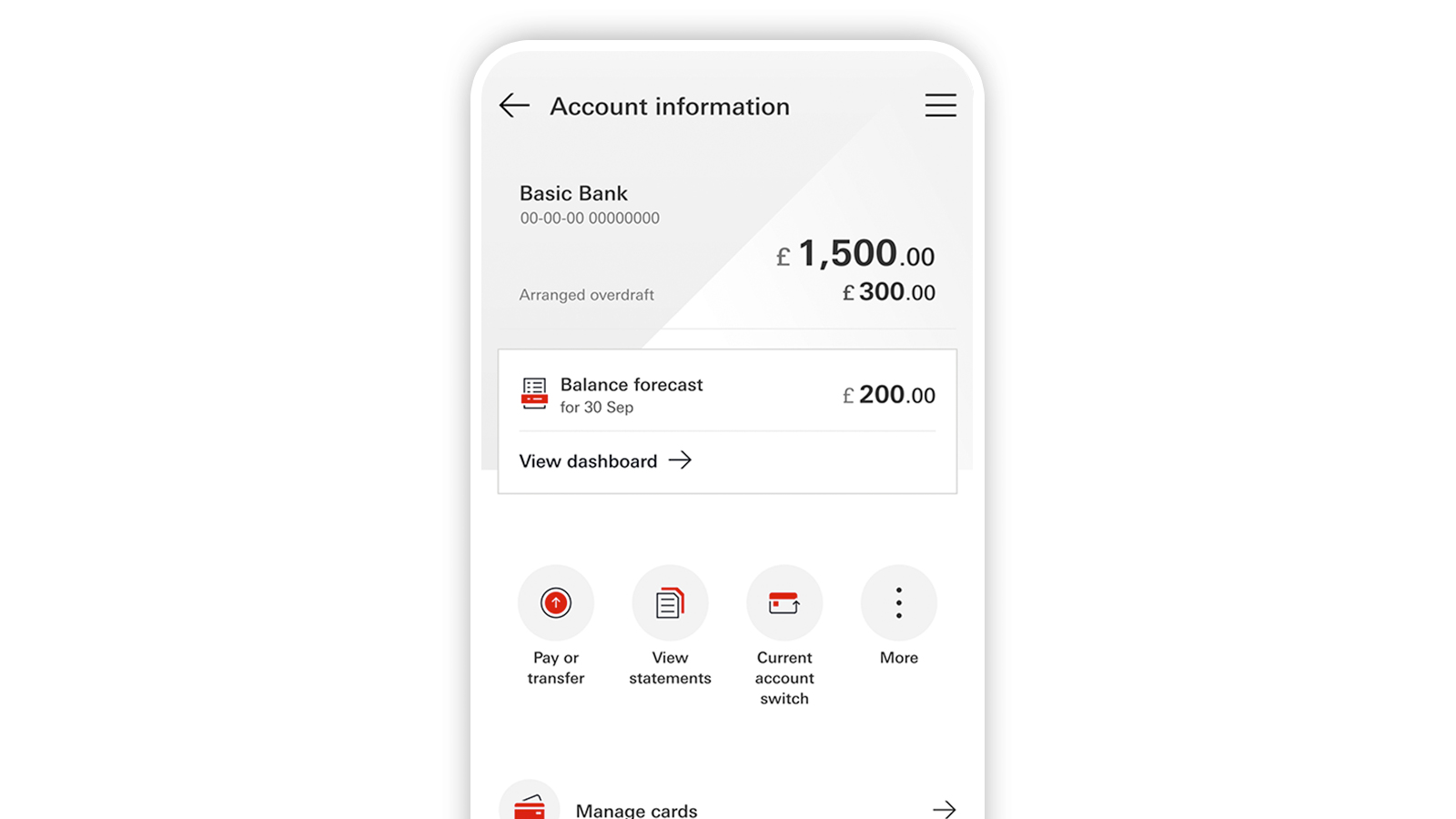

Manage your money with our app

Take care of your banking in no time with our Mobile Banking app. Check your balance, set up bill payments and more. If you prefer, you can also bank online, in-branch or by phone.3

Know exactly where you stand

Use our smart money tools to manage your budget more easily. And get help to stay on top of your spending, with instant notifications when money goes in or out of your account.4

See your spending broken down into categories and set targets to help control it with Spending insights and Monthly budgets.

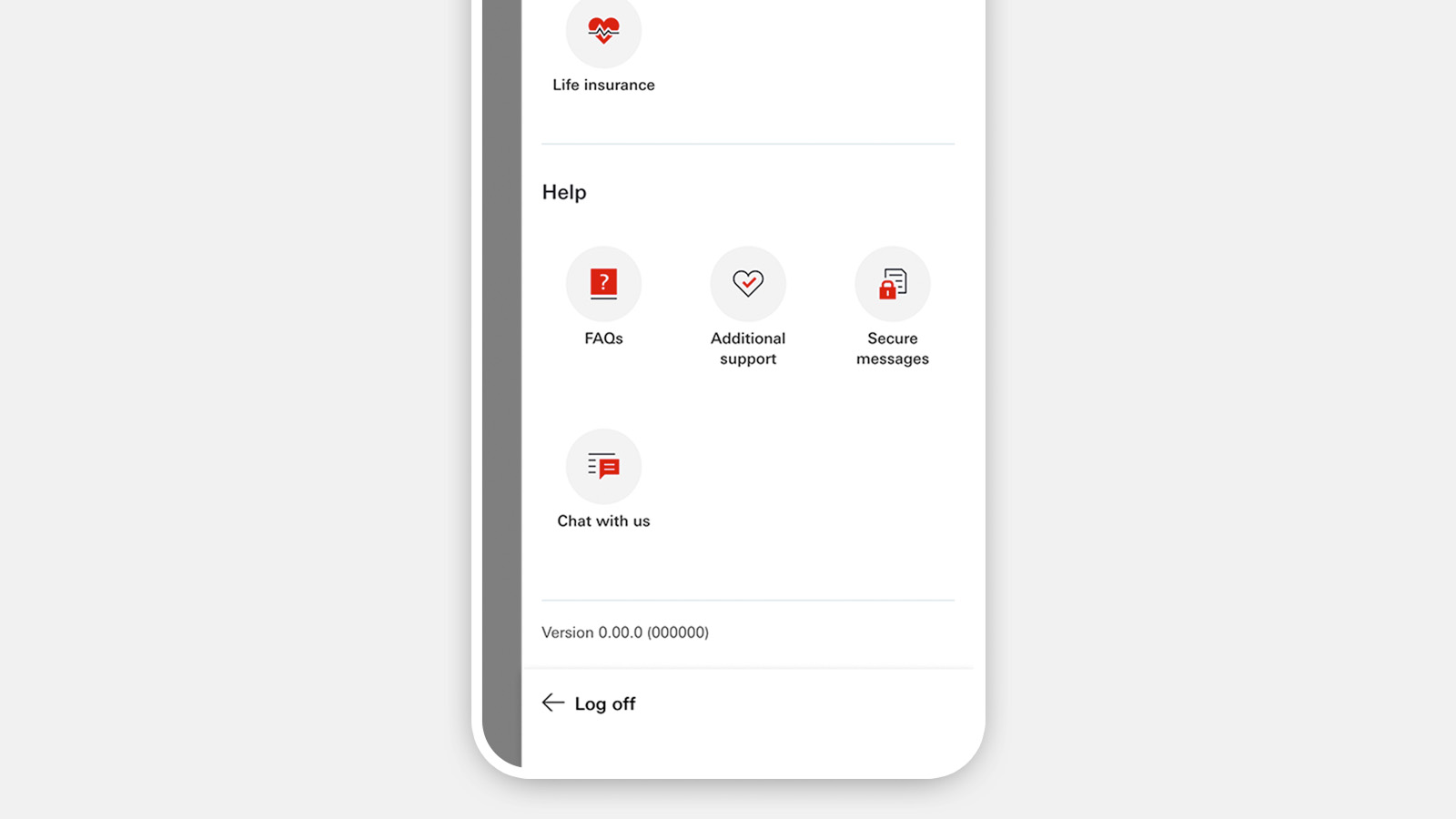

Get help whenever you need it

If you ever need support, we're always on hand. You can chat to us in the app, by phone, by Live Chat on our website, or by popping into one of our branches nationwide.

Who can apply?

You may be eligible for a Basic Bank Account if you:

- don't qualify for one of our other current accounts

- are 16 or over and live in the UK

- are happy for us to do a credit check against your name (if you live in the UK)

- can provide ID and proof of address if needed

- have read the important account documents below

Want to apply for an account?

Are you aged 18 or over?

To apply, we need to first check if you’re eligible for a standard HSBC Bank Account. If you apply for that account but don’t qualify, we’ll automatically offer you a Basic Bank Account as an alternative without needing to reapply if you’re eligible.

Are you aged 16 or 17?

If you’re aged 16 or 17, we need to first check if you’re eligible for our HSBC MyMoney account. You can apply online if your parent or guardian has an HSBC current account and is registered for online banking. Otherwise, you can apply for a MyMoney account in a HSBC branch.

If you aren’t eligible for a MyMoney account, you can apply for our Basic Bank Account in a HSBC branch.

Frequently asked questions

Your eligible deposits with HSBC UK Bank plc are protected up to a total of £120,000, or up to £240,000 for joint accounts, by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme.

This limit is applied to the total of any deposits you have with the following: HSBC UK Bank plc, HSBC Private Banking, and first direct.

Any total deposits you hold above the limit between these brands are unlikely to be covered.

You might also be interested in

Other current accounts

Take a look at our full range of current accounts, all with no monthly account fee.

Money worries

Concerned about your financial situation? Find out how we could help.

Additional information

1. While we'll take all reasonable steps to stop your account going into an unarranged overdraft, there may be some situations where this happens. We won't charge you any interest or charges if it does.

2. Find out more about the operating systems our app works on.

3. Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries. Google Pay is a trademark of Google LLC. Samsung Pay is a registered trademark of Samsung Electronics Co., Ltd.

4. You'll need to opt in to receive instant notifications. You can do this in our app. This feature is currently being rolled out and may not yet be available on some older devices.