We're here to help you start investing

Investing is a way to set aside money today to use in the future. Unlike with a savings account, there aren't any guarantees with investing, but your money could grow more over time. And, you could use a stocks & shares ISA as your investment account.

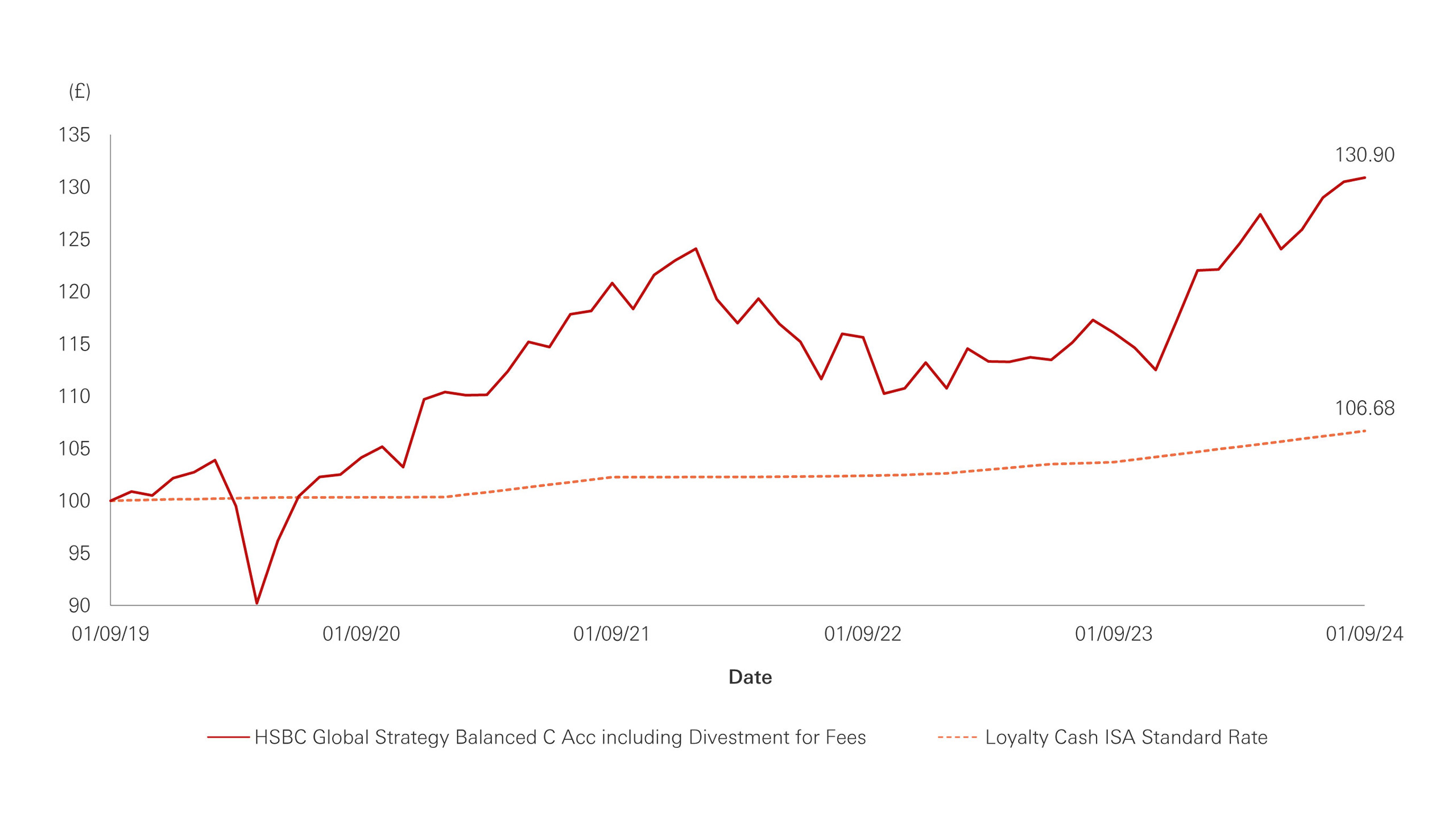

For instance, the chart shows that:

- £100 invested in the HSBC Global Strategy Balanced Portfolio on 1 September 2019 would have been worth £130.90 by 1 September 2024.

- £100 invested in the HSBC Cash ISA would have only been worth £106.68 by the same date.

Our Balanced portfolio has a risk level 3 out of our range of 5 and is designed for new investors.

Remember, the value of investments can go down as well as up, so you may not get back what you invest. Also, keep in mind that past performance is not a reliable guide to future performance.

Get to know more about investing

| How much do I need to start? |

Start investing with £50 – either a lump sum or regular payments.

Be sure to keep some money aside to cover for emergencies, so you're less likely to dip into your investment.

How long should I invest for?

We recommend you aim to invest for at least 5 years – although, your money won't be locked away.

You can sell your investments and the money will be in your account within 5 days.

What should I invest in?

For new investors, our ready-made portfolios are an easy place to start.

Our team of specialists will spread your money across a mix of investments. Just choose your level of risk and they'll take care of the rest.

How much risk should I take?

That depends on how you feel about uncertainty. Lower risk funds, like the one shown in the chart, aim to achieve a modest but stable return on your investment. Whereas, higher risk funds can offer you a higher potential reward with a potentially bumpier ride. |

Start investing with a ready-made portfolio

Explore our choice of 5 ready-made portfolios, each with a different level of risk and potential reward. They're an easy way to start investing and you could find the one that suits you.

An award-winning way to invest

Invest online or straight through your app

We're delighted to have won awards for how easy it is to invest through our app and for our dedicated investment customer service.

Why not try investing with the app yourself?

Just tap the 'Menu' icon in the top right corner. Then select 'Plan' to create a goal and start investing towards it.

Frequently asked questions

You might also be interested in

Investment calculator

Use our calculator to see how your investment could potentially grow over time and under different market conditions.

Is investing worth the risk?

Get to grips with risk and learn how it could impact your money.

Investment goals

A smart way to invest and track your long-term goals in the latest version of the app.

Investing for beginners

Learn the basics of investing to work out whether it’s right for you.