Stay on top of your finances

The smart money tools in our app help you keep an eye on your spending and stay on top of your finances. Not only can they help you keep within your budget, they may also help you grow your money and achieve your financial goals.

What's the plan when it comes to your finances?

Our 'Money management' feature in the HSBC UK Mobile Banking app has a range of useful tools to help you manage your money. These include Spending insights, Monthly budgets and the Financial fitness tool, with more to follow. To start using it:

- Log on to the HSBC UK Mobile Banking app

- Tap the 'Menu' icon in the top right corner, then tap 'Plan'

- Choose the option you’re interested in

You'll also need the latest version of our app and an operating system that supports it.

Spending insights

You can now see your monthly spending broken down into different categories, giving you a better insight into your spending. You’ll also see personalised monthly insights on HSBC current accounts and credit cards, such as your ‘top category’ and ‘top spend’, and be able to compare your spending month on month.

Monthly budgets

Create and track a budget on HSBC current accounts and credit cards for that month's spending category to help you take control of your money. Once a budget is set up, a helpful visual offers easy tracking of your spending against your set budget. This helps you to understand how you're spending your money. You’ll also be able to see a percentage of your spend versus your set budget.

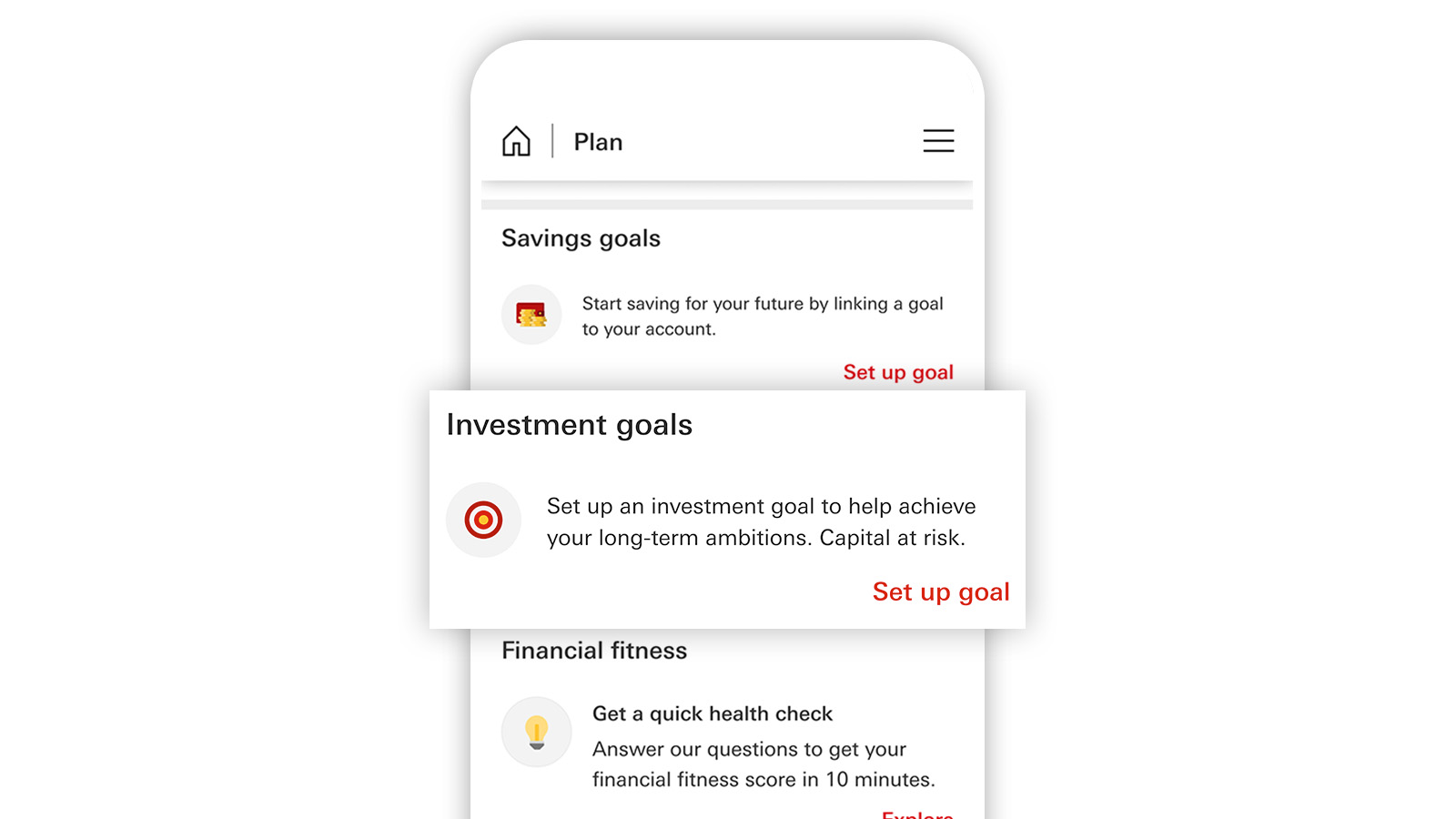

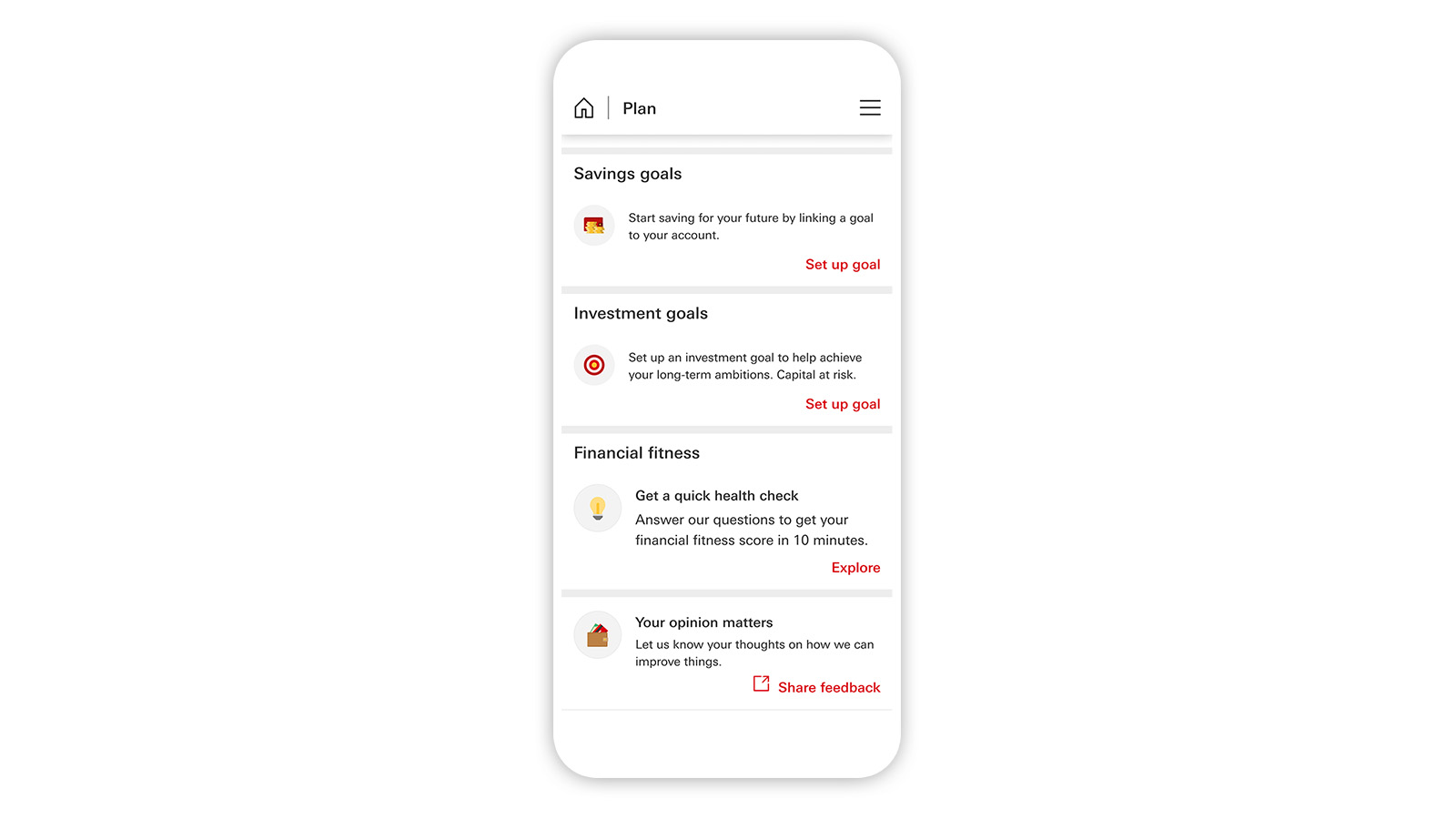

Investment goals

Discover a smart way to invest and track your long-term goals in the latest version of the app. To set up an investment goal:

- Log on to the HSBC UK Mobile Banking app

- Tap the 'Menu' icon in the top right corner

- Select 'Plan', then ‘Set up goal' under 'Investment goals' and follow the on-screen instructions

Remember, investing has its ups and downs, so you could get back less than you invest. Eligibility criteria and fees apply.

Financial fitness

Access a range of helpful tools and guides to help you achieve your goals, using the financial fitness materials in our app. This includes the ability to check your financial fitness score, book an appointment with one of our financial fitness trainers or just browse relevant articles.

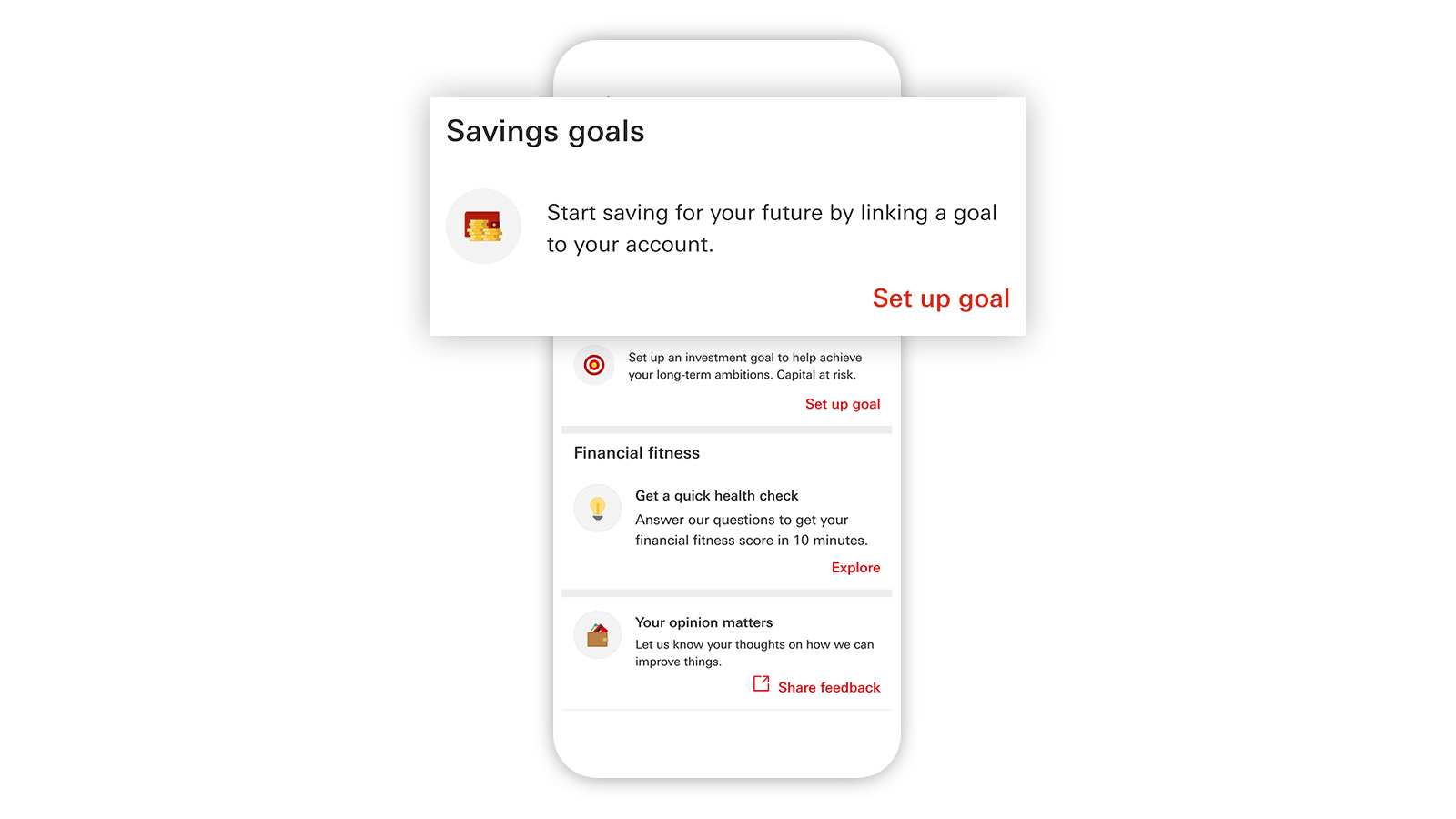

Savings goals

If you're looking to set up short term goals, our new savings goal feature could be for you.

If you've an Online Bonus Saver, Premier Saver, Flexible Saver or Loyalty Cash ISA you can set up your saving goals using the app.

- Log on to the HSBC UK Mobile Banking app

- Tap the 'Menu' icon in the top right corner, then tap 'Plan'

- Tap 'Set up goal' under 'Savings goals' section

- Find out more by reading the on-screen information and tap 'Set up goal'

- Select the account where you would like to create the goal, then tap 'Continue'

- Enter a name for your goal, choose a goal category and the amount you would like to save by the target date

- Tap 'Fund your goal' to complete and start saving

Other mobile features to help you manage your money better

Transaction notifications

We’ll send you push notifications to help you keep track of payments, spending and suspicious activity. You’ll also get alerts when your card is declined, with an explanation and next steps. To set up notifications:

- Log on to the HSBC UK Mobile Banking app

- Tap the 'Menu' icon in the top right corner

- Tap the 'Profile' icon in the top right corner

- Tap ‘Communication preferences’, then ‘Push notifications’

- Turn the transactions toggle on and select the accounts you want to receive notifications for

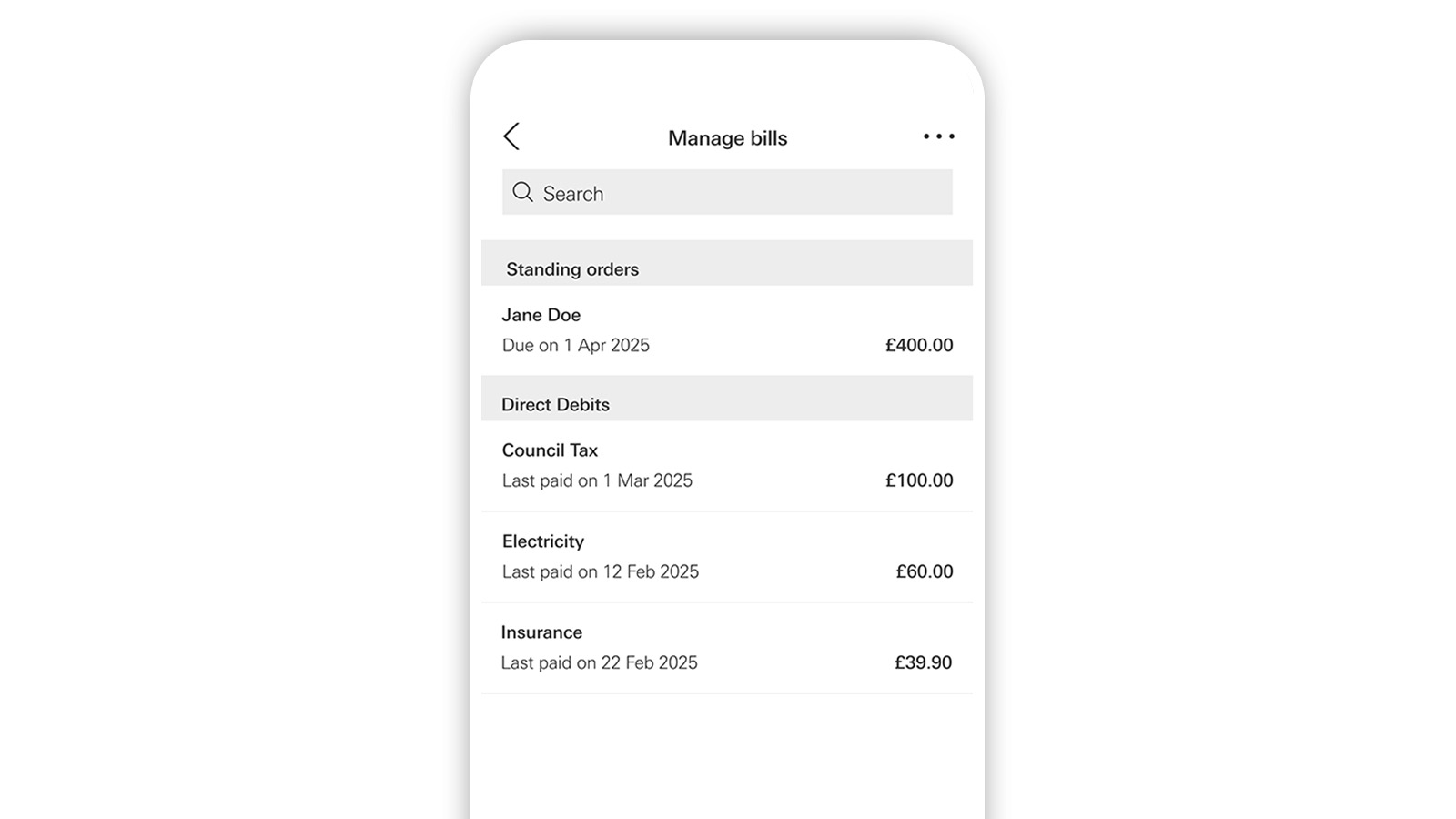

Manage bills on the go

Manage your monthly payments in our app. View, set up and delete standing orders, and view or delete any Direct Debits.

Just log on to the HSBC UK Mobile Banking app, select your account, then go to 'Manage bills'. From there you can access all your standing orders, Direct Debits and subscriptions. To manage them, simply select each payment.

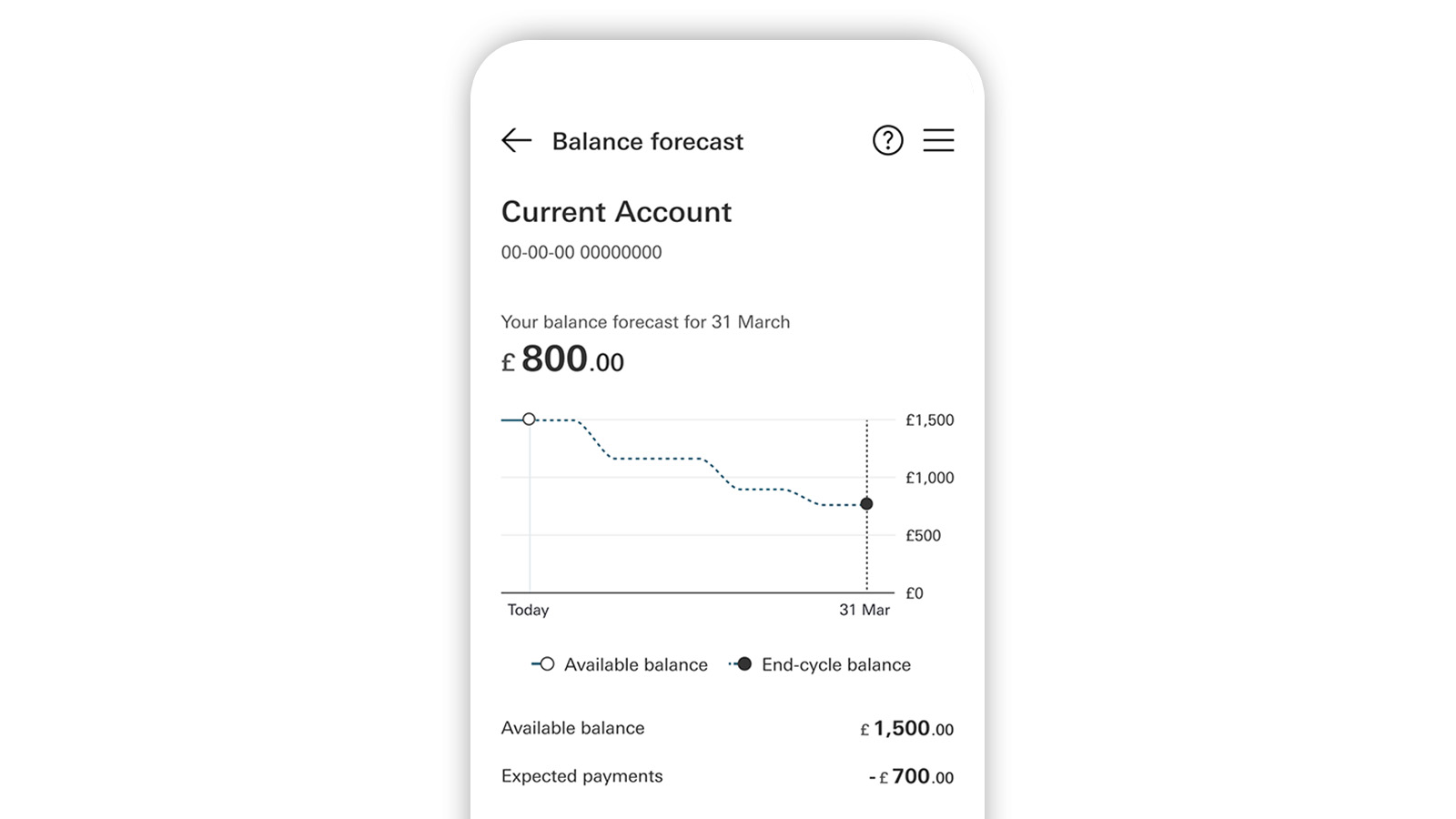

Balance forecast

We've a number of app tools to help you manage your money, keep track of your spending and reach your savings goals.

Balance forecast helps you budget from one payday to the next. It shows your month-end balance once known standing orders and Direct Debits are deducted, and alerts you to possible shortfalls.

If you've not activated balance forecast:

- Log on to the HSBC UK Mobile Banking app

- Go to your current account under 'Your products'

- From your Quick actions, select 'More' and select 'Balance forecast'

If you've already activated Balance forecast:

- Log on to the HSBC UK Mobile Banking app

- Scroll down to the 'Balance forecast' widget - tap it to view your balance forecast dashboard

Frequently asked questions

Download the app

The HSBC UK Mobile Banking app lets you manage your accounts easily and securely from a time and a place that suits you. Discover an ever growing range of services and features on the app to make your banking more convenient.

Explore more

Financial fitness calculator

Find out your financial fitness score with our easy-to-use calculator.

Budget planner

Take control of your spending with our budget planner. It’ll help you work out where your money goes and see if you can start saving more.

Savings goals

Saving for something special? Using our in-app feature can help you reach your goals.

Investment calculator

Use our calculator to see how your investment could potentially grow over time and under different market conditions.