4 March 2026

US stocks declined on Tuesday amid geopolitical tensions in the Middle East. The S&P 500 ended 0.9% lower.

US Treasuries fell as higher oil prices raised inflation expectations. 10-year yields rose 3bp to 4.06%.

European stocks fell sharply on ongoing geopolitical tensions on Tuesday. The Euro Stoxx 50 fell 3.6%. The German DAX dropped 3.4% and the French CAC lost 3.5%. In the UK, the FTSE 100 ended 2.7% lower.

European government bonds fell. 10-year German bund yields rose 4bp to 2.75%, and 10-year French bond yields climbed 8bp to 3.37%. In the UK, 10-year gilt yields jumped 10bp to 4.47%.

Asian stock markets declined on Tuesday amid ongoing geopolitical tensions and higher oil prices. Japan’s Nikkei 225 lost 3.1%, while Korea’s Kospi dropped 7.2% as the market reopened after a public holiday. Hong Kong’s Hang Seng and China’s Shanghai Composite ended down 1.1% and 1.4%, respectively. India’s financial market was closed for a public holiday.

Crude oil prices extended gains on Tuesday. WTI crude for April delivery settled 4.7% higher at USD74.6 a barrel.

In the Eurozone, headline CPI inflation rose slightly to 1.9% yoy in February, from 1.7% yoy in January, above market expectations. The core rate picked up to 2.4% yoy in February from 2.2% yoy in January.

In the UK Spring statement forecast, the Office for Budget Responsibility (OBR) lowered its 2026 GDP growth forecast, whilst modestly reducing its projection for government borrowing over the medium-term.

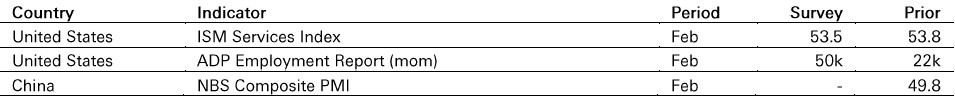

In the US, the ISM services index has improved since late 2025, in contrast to the softening seen in the services PMI.

In the US, the ADP has posted modest gains in jobs since mid-2025 and the trend is forecast to continue in February.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.