26 May 2025

A dominant theme in the minds of investors this year has been the prospect of an end to US exceptionalism. The previous week’s US credit rating downgrade by Moody’s – while not exactly unexpected – provided a reminder that the US fiscal situation has become untenable. But when we talk about an end to exceptionalism, what has really changed?

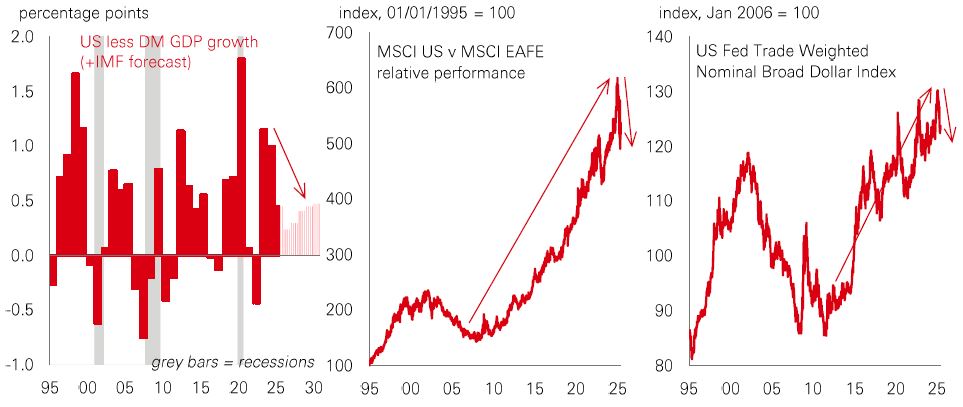

Over the past decade, investors have enjoyed three types of US exceptionalism. The first is the country’s exceptional GDP growth, especially within the context of the G10 (although a lot of that has been more about fiscal spending and immigration, than it has about productivity). Second is its exceptional stocks. Returns have been boosted by super-normal profits, the Magnificent Seven tech mega-caps, and a big re-rating of the market multiple. Thirdly, there has been the exceptional US dollar. The USD has boosted investor returns and sucked up global capital and investor attention. It also provided portfolio hedging services to global investors – offering strength in times of both US economic outperformance and weak global growth (the “dollar smile”).

The critical question now is the extent to which these elements survive? For a start, macro growth is cooling amid policy uncertainty, and that could persist as a dampening effect on US activity for a while. Meanwhile, the premium growth rates are in Asia and Frontier economies. In stocks, the US market cap as a percentage of global stock markets looks to have made a top. And profits growth is expected to be as fast in China as in the US over the next 12 months. As for the USD, it remains over-valued versus most currencies, and many global investors are now exploring hedging FX for US stock exposures – which is a material shift in psychology. The forces making the US look less exceptional could stick around for a while.

Rollercoaster US stock market volatility in the early months of 2025 has given way to a pronounced rally in May. But with fund manager surveys pointing to some unusually bearish institutional positioning in US stocks, it seems that something else has been driving recent moves.

According to reported flows data, US stock prices since late April have been supported in part by a pick-up in buying among retail investors. In a repeat of a theme that’s been a fixture in markets for the past decade – particularly in the rebound after the Covid crash of 2020 – retail has been acting like a stabilising force and “buying the dip”.

The latest leg-up in prices followed the better-than-expected deal in early May between the US and China to cut tariffs for 90 days. But while developments like that help explain the shift in investors’ perception of risk, there’s potential for it to drive a disconnect between market performance and still ultra-high policy uncertainty. While retail investors got the rally started, the momentum could fade quickly if smart money institutions fail to join in – potentially causing further volatility, with markets continuing to spin around.

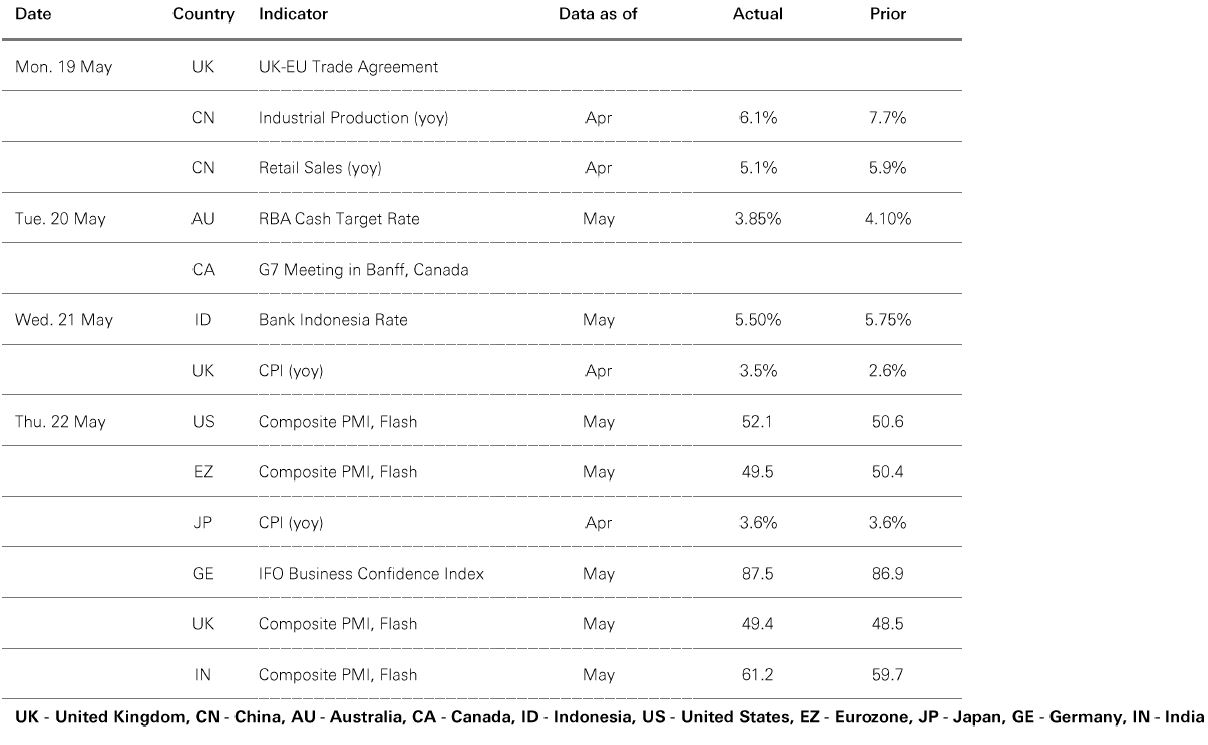

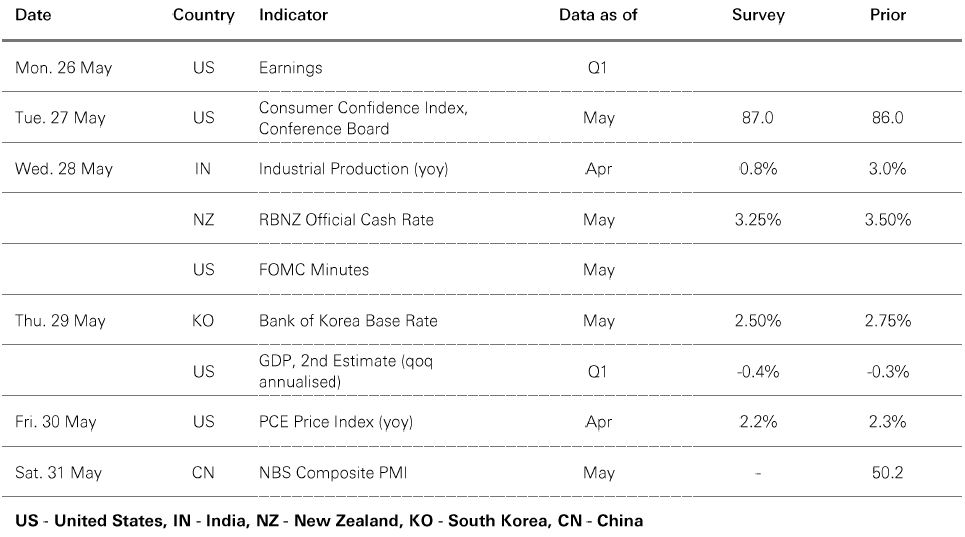

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg. Data as at 7.30am UK time 23 May 2025.

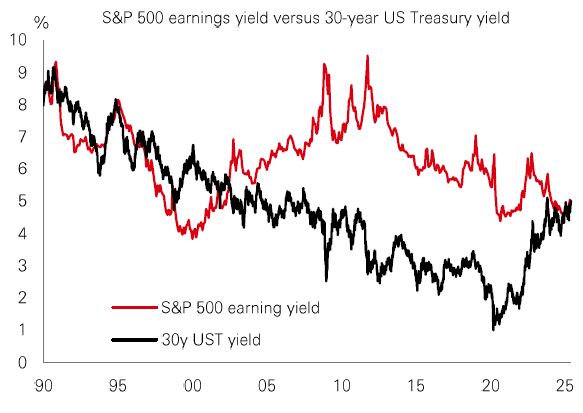

While the details of the “One, big, beautiful bill” are yet to be finalised, it is likely to include fiscal easing over and above the extension of the TCJA. However, Washington will have one eye on the bond market and the USD – the 30-year yield breached 5% last week while the USD is softening again. Meanwhile, although tax cuts may be seen as positive for the stock market, this may be offset by a renewed rise in yields. So, a key question for investors is do these ugly truths force the White House to pare back its ambitions?

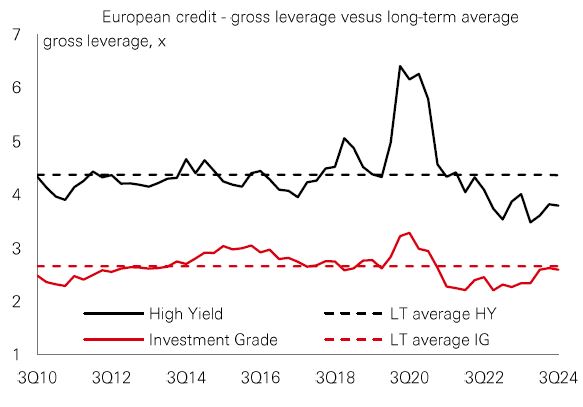

When Mario Draghi published his blueprint to revive the EU economy last year, he said the bloc needed sharp increases in public and private investment. So, when Germany – with its long record of fiscal prudence – announced plans for massive spending on infrastructure and defence six months later, no wonder Draghi called it a “game changer”. German fiscal expansion, together with expectations of further ECB rate cuts, have improved the prospects for the eurozone economy. Some credit research teams suggest one spillover effect could be a positive change in sentiment in European credit markets. |

European corporate credit fundamentals are healthy, with steady gross leverage and resilient profitability. Coverage ratios (measuring the ability of firms to service debts) have dipped, but many have strong cash buffers. The asset class should also be resilient to tariffs, with only a limited proportion of both IG and HY markets made up of US registered companies, while direct sales exposure to tariffs is also limited. One note of caution is that a lot of this good news is in the price – spread valuations remain tight. But high all-in yields are compelling for investors looking for steady income flows.

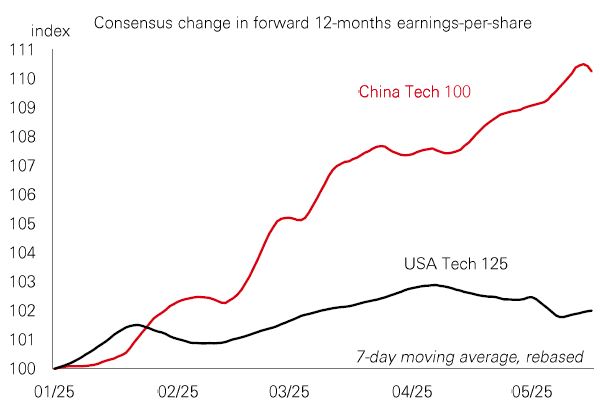

Last week, a major Chinese battery maker pulled off the biggest share sale in the world this year, with a multi-billion dollar secondary listing in Hong Kong. The move could bode well for other China-quoted firms hoping to attract funding from both domestic and foreign investors. It comes amid signs of continuing positive sentiment towards Chinese stocks this year, especially in technology-related sectors, with investors seeking to broaden their international exposure beyond the US. |

Growing global appetite for Chinese stocks coincides with a recent pick-up in earnings upgrades. That’s been driven by cooling trade tensions between the US and China, and Q1-2025 profits numbers from Chinese firms that are largely in line with market consensus, delivering decent year-on-year growth. In the offshore market, technology industries are the profit engine, with AI still expanding at a clip. In the onshore market,the strongest growth has been in consumption-sensitive sectors like consumer discretionary and staples, in part because of ongoing policy support and the expectation that policymakers will respond (with a “put”) if headwinds worsen. Put together, these latest developments could be a catalyst for further positive performance in Chinese stocks.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 23 May 2025

Source: HSBC Asset Management. Data as at 7.30am UK time 23 May 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Risk sentiment pulled back last week amid growing worries about US debt sustainability, following the US House of Representatives’ passage of a bill extending the 2017 tax cuts last week and Moody’s downgrade of the US credit rating the previous week. The US dollar weakened while longer-dated US Treasury yields rose, with the 30-year yields breaching 5.00%. UK gilt yields also rallied, and most European yields rose too, albeit to a lesser extent. US HY credit spreads widened after weeks of narrowing, while IG spreads remained stable. In equities, US markets saw broad-based losses, while the Euro STOXX50 were largely unchanged. The DAX rose, whereas the CAC40 edged lower. Japan's Nikkei 225 declined amid a stronger yen, and other Asian equities were mixed: Hong Kong’s Hang Seng and mainland China’s Shanghai Composite gained, while South Korea's Kospi and India's Sensex fell. In commodities, oil prices dropped amid investor concerns over a potential increase in OPEC+ production. Gold advanced, and Crypto extended their weekly rallies.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.