28 April 2025

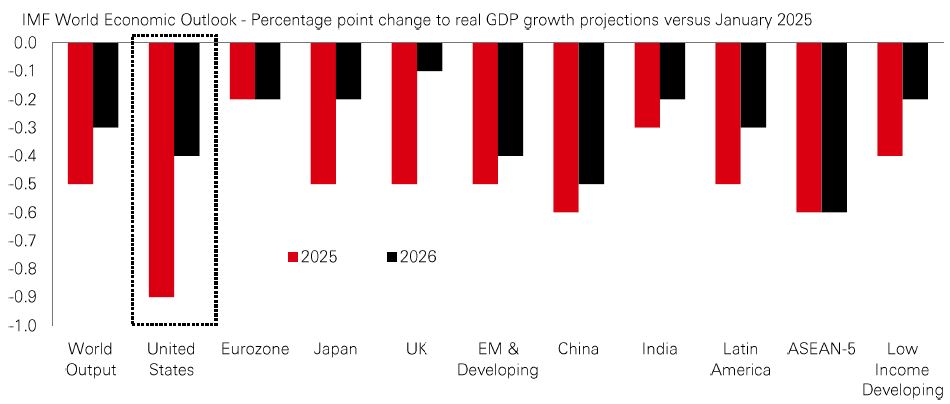

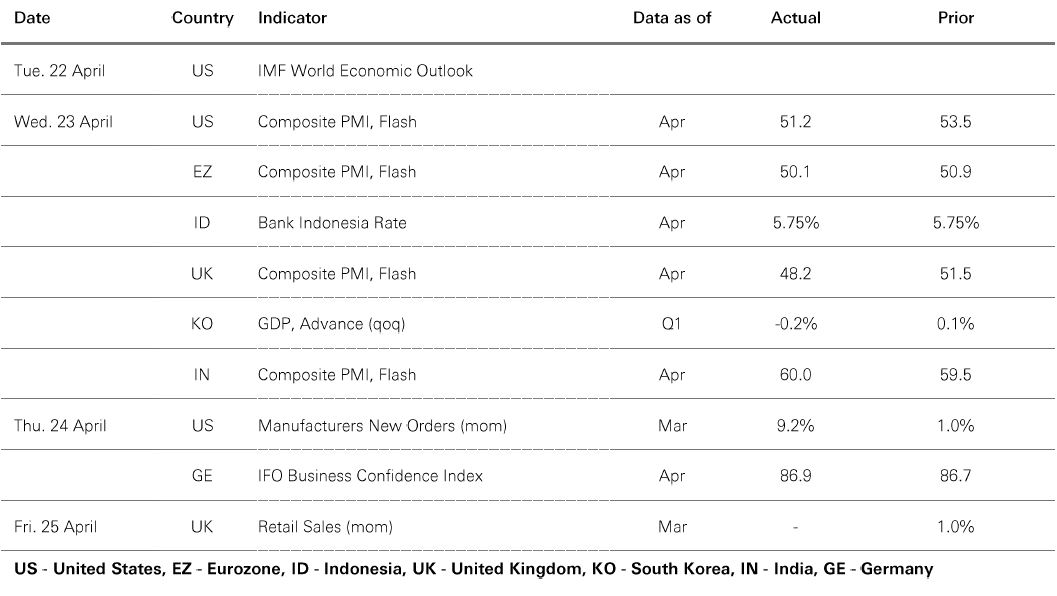

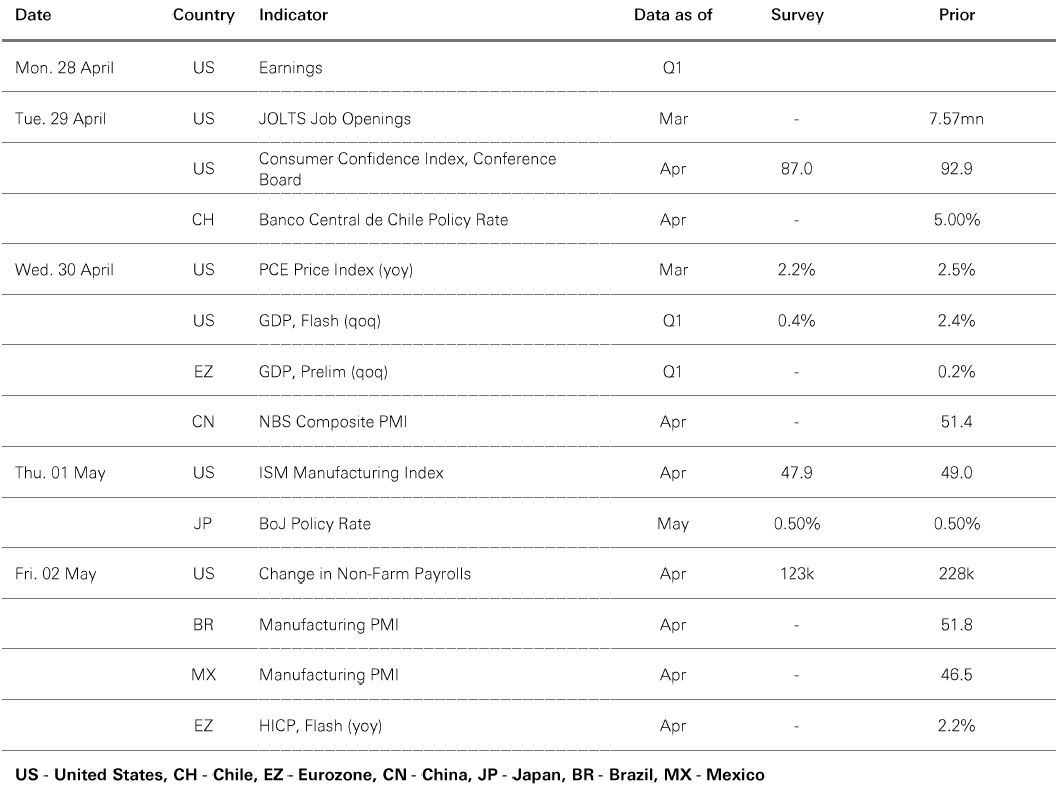

The latest IMF World Economic Outlook (WEO) has delivered some hefty downward revisions to global growth forecasts for the next couple of years. As recently as January, the same economists were sounding upbeat on the outlook for both developed and emerging markets. But faced with radical uncertainty in the macro and market environment in 2025, their tone has turned undeniably bearish.

Near term, the WEO’s reference forecast (based on data as of 4 April) shows global growth is projected to fall from an estimated 3.3% in 2024 to 2.8% in 2025, before bouncing back to 3% in 2026. Compared to January’s expectations, those projections represent a 0.5 percentage point fall for 2025, and 0.3 percentage points for 2026. And there have been downward revisions for nearly all countries. At the extreme, the US has seen a sharp downgrade to its growth forecast for 2025, which now stands at 1.8%.

These revisions reflect recent disappointing data on real activity, and now major policy shifts in global trade – despite signs that the US administration may be considering a more dovish approach to negotiations. They follow a similarly downbeat report from the WTO the previous week showing the volume of world merchandise trade is projected to fall by 0.2% in 2025. That’s almost three percentage points lower than it would have been without the recent policy developments.

Put simply, swingeing cuts to US growth expectations is more evidence that we could be seeing the end of US exceptionalism. And as the US catches down to the rest of the world, investors are likely to eye global opportunities that have long been out of favour. But with radical uncertainty thrown into the mix, it’s likely to be bumpy out there.

Trade policy uncertainty and the recent pick-up in market volatility have caused asset class correlations to go haywire in recent weeks, with stocks and bonds both selling off. This presents challenges for allocators, given that US Treasuries have historically been a natural portfolio diversifier to stocks because of their usually uncorrelated relationship. But in the face of volatility, and a potential growth slowdown, one asset class that could be well positioned to fend off these headwinds is securitised credit.

Given its floating rate nature, securitised credit moves differently to other asset classes during economic cycles and offers an alternative source of risk adjusted returns. In particular, it can reduce portfolio duration, generate income and potentially enhance returns as spreads tighten.

For securitised credit, low correlation to regular fixed income, and lower correlation to stocks than corporate bonds could make it a key option for multi-asset portfolios. Given the high starting income levels and relatively wide securitised credit spread (compared to history), the combination of both factors could generate an attractive total return for investors.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg, IMF. Data as at 7.30am UK time 25 April 2025.

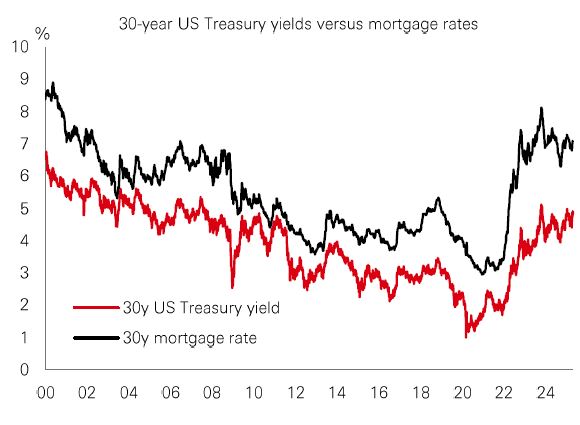

While the sharp drop in US equities following President Trump’s 2 April tariff announcements likely rattled the US administration, the spike in longer-dated yields was probably the deciding factor behind the 9 April decision to delay implementing reciprocal tariffs on most countries. The sharp weakening of the US dollar – as opposed to a desired gradual depreciation – likely played a role too. The same combination also seems to have led the administration to back away from suggestions that Fed Chair Powell’s position was under scrutiny earlier last week. |

Rising longer-dated US Treasury yields are important for two main reasons. First, with federal debt level already elevated and rising, higher borrowing rates can undermine the administration’s tax cutting ambitions. Second, the 30y yield drives mortgage rates in the US. While off their recent 2023 highs, mortgage rates are still around 7%, a level not seen on a sustained basis since the early 2000s. Failure to deliver tax cuts, combined with higher mortgage rates, would undermine already-fragile consumer confidence, adding to downside growth risks – something that the US administration is keen to avoid.

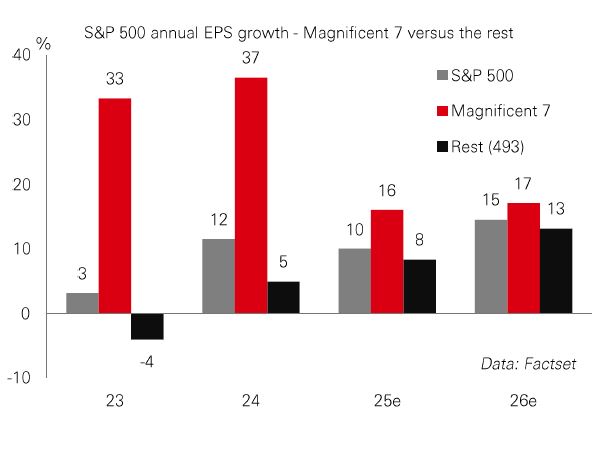

Q1 earnings season continues in the US, and after another week of big market whipsaws, all eyes are on the profit growth outlook and the potential impact of tariffs. Analysts expect year-on-year (yoy) profit growth in the S&P 500 of 10% for 2025 and 15% for 2026. For Q1, Factset data shows expected yoy growth of 7.2%. As normal, expectations have fallen ahead of results season, but with a quarter of companies having now reported their figures, the beats are less than average. Outlook statements have been vague to non-existent to boot, with more downgrades possible. |

As for the Magnificent 7, analysts expect them to grow by around 15% yoy in Q1, which, while high, is less than half their growth rate last year. And while their profits continue to grow faster than the rest of the S&P 493, the gap is fading. The focus here is on competition/ capex spend and whether heady valuations remain justified. The Mag 7 index has fallen by 23% peak-to-trough this year. And while there could be selective value emerging within, it still trades on an elevated 12m forward PE of 24x. Some equity analysts prefer the equal weighted index, where growth expectations are lower, but so is the 16x PE.

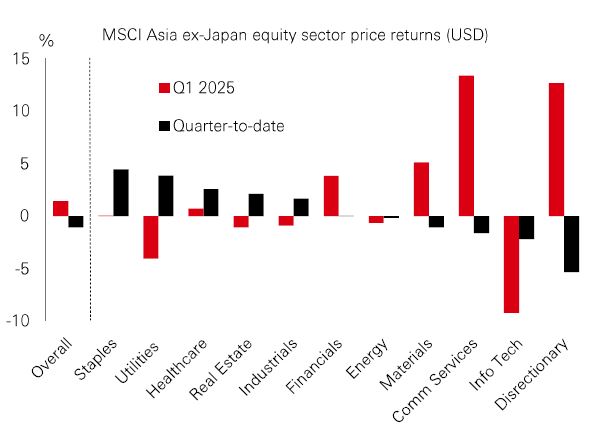

Despite the uncertainty, analysts still expect average earnings growth in Asia ex-Japan to just about push into double digits in 2025-2026. That’s being driven by the region’s burgeoning tech-related sectors, with optimism over long-term demand for semiconductors and hardware, and areas like AI, robotics, and e-commerce. Meanwhile, materials, financials, and healthcare are all potentially well-placed to benefit from regional infrastructure development, a resilient domestic backdrop, and the expansion of the middle classes – particularly in areas like India. Some Asian analysts see the market continuing to offer broad sector diversification and attractively-valued quality-growth opportunities, albeit with a focus on careful stock selection given the backdrop of policy uncertainty.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 25 April 2025.

Source: HSBC Asset Management. Data as at 7.30am UK time 25 April 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Risk market sentiment improved on signs of potential easing in global trade tensions, despite the IMF’s downgrades to its GDP forecast due to a recent “surge in policy uncertainty”. Investors continued to monitor corporate earnings releases and assess the Fed’s policy outlook following remarks from officials. The US dollar paused for breath after recent weakness, while core government bond yields extended their modest declines. US and euro credit spreads further compressed, with HY outperforming IG. In the stock markets, the US experienced broad-based gains, led by the tech-dominant Nasdaq. European equities further rebounded, and Japan’s Nikkei 225 advanced as exporters recovered ground, with trade negotiations and the upcoming BoJ policy meeting in focus. Other Asian markets also posted decent gains, led by Hong Kong’s Hang Seng. Meanwhile, LatAm markets rallied, including stocks in Mexico and Brazil. In commodities, oil prices retreated. Gold consolidated after reaching a record high, while copper continued to rise.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.