12 May 2025

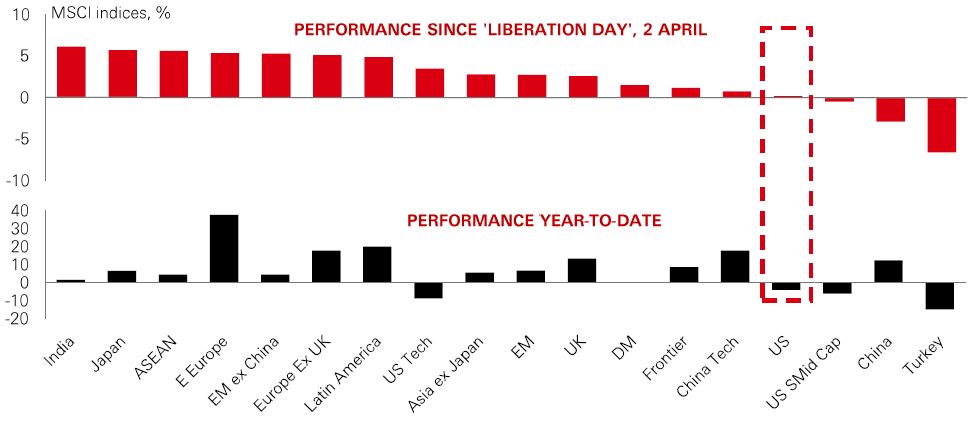

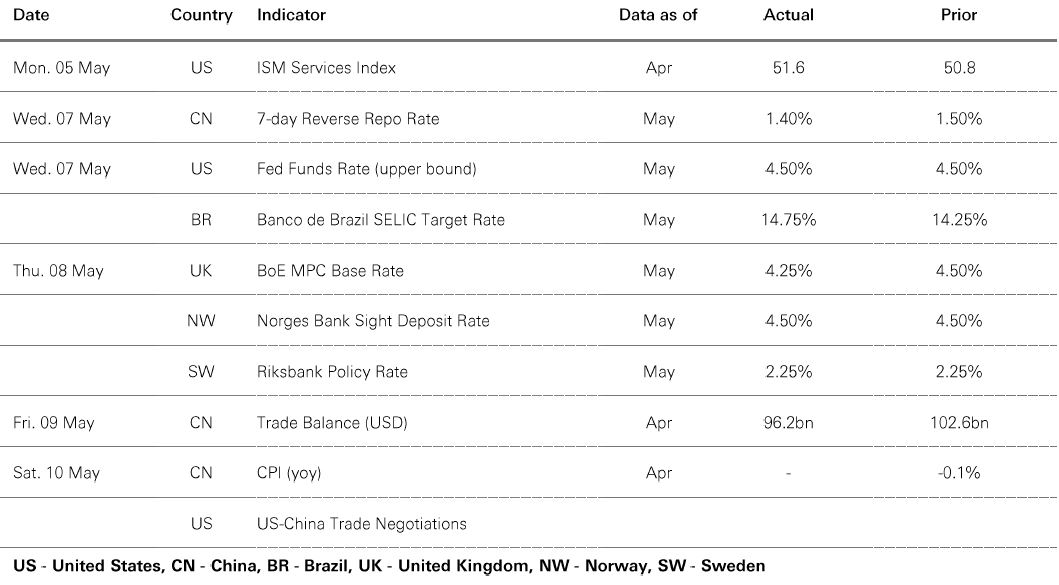

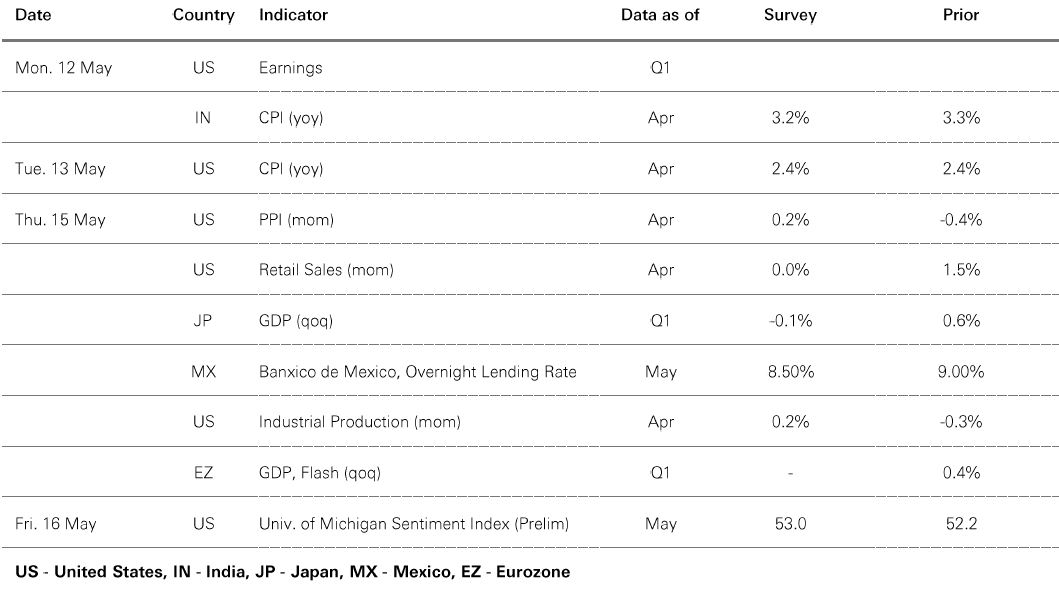

It took five weeks, but US stocks have finally recovered from the global market sell-off sparked by the ‘Liberation Day’ tariff proposals in early April. The relief rally has played out amid falling volatility, still-high valuations and profits expectations, tighter credit spreads, and a sense of calm in Treasury bonds. Put together, it suggests that recession isn’t priced anywhere in investment markets right now. But policy uncertainty remains ultra-high, and the July deadline to restore reciprocal tariffs still looms. So, what has driven this rebound?

For a start, US economic momentum at the beginning of the year was strong. Facts about the labour market and profits – including a solid Q1 earnings season – remain good. There’s been some growth cooling, but nothing more than that – at its May meeting, the Fed concluded “economic activity has continued to expand at a solid pace”. Meanwhile, there’s a sense on global trade that we’re moving from ‘tariff escalation’ to negotiation. A more dovish tone from US leaders has helped, and constructive talks between China and the US could be a further boost for markets. Last week saw US-UK and UK-India trade agreements, and there have been accelerated talks between China, Japan, and South Korea.

But despite signs of progress on trade, there is still cause for concern. In the soft data, US consumer and business confidence has fallen sharply in the face of uncertainty. And it could be that lagging hard data will eventually “catch down” with weak survey data in the coming months. While markets have rebounded, the underperformance of the US versus EAFE regions in Asia (particularly India and Japan), Europe, and Emerging Markets, reflects a ‘wait-and-see’ stance by investors and the ongoing risk that policy uncertainty could provoke further volatility.

Amid the recent pick-up in market volatility, traditional diversification strategies have not proved reliable, with stock-bond correlations going haywire at times. But one asset class proving resilient is hedge funds. A recent review by some alternatives specialists shows that typical balanced hedge fund portfolios have insulated against as much as 90% of recent market weakness.

As expected, some hedge fund strategies have been well-suited to the conditions. Equity market neutral strategies in particular, tend to benefit from volatility, and they have performed well. Macro fund managers have also enjoyed some success, especially in trading rates and commodity markets. But net-long and long/short equity market strategies have faced a tougher test given the weakness in US stocks, and their performance has retraced sharply.

Given that recent volatility has been partly driven by policy uncertainty, some investment specialists expect further volatility to come. Indeed, allocators may need to lean ever more heavily on their hedge fund portfolios in the coming years to maximise returns. For Q2, the environment remains tricky for many strategies, but some specialists are most positive on ‘equity market neutral long/short’ and ‘multi-strategy multi-portfolio manager’ funds.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg. Data as at 7.30am UK time 09 May 2025.

Recent weakness in the US dollar has been down to worries over US growth, high deficits, and an end of US exceptionalism. But it’s no secret that the US is keen on a weaker USD to improve trade competitiveness. Back in the 1980s, it did it with the ‘Plaza accord’, a multilateral deal to weaken its currency. While a similar ‘Mar-a-Lago accord’ might not be achievable now, countries with large external surpluses might let their FX rates strengthen against the USD to smooth the way for new trade deals. |

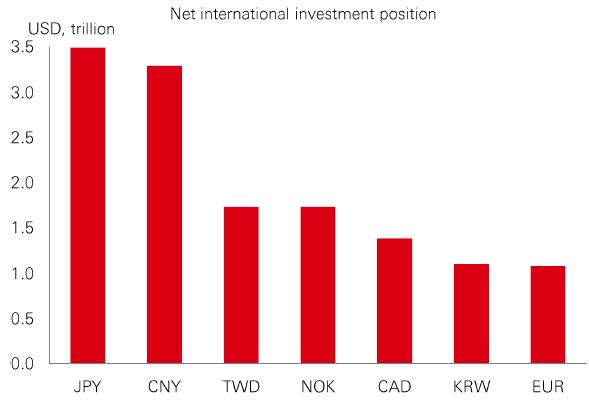

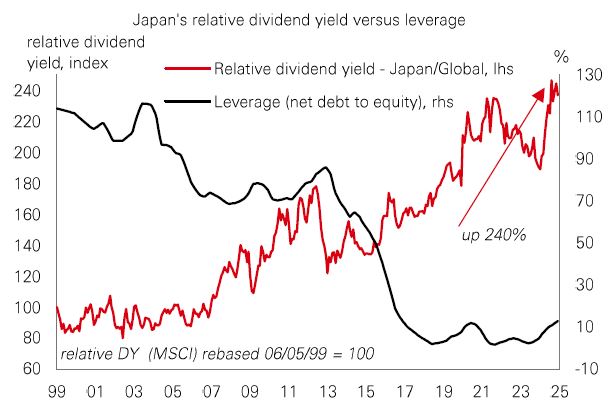

Persistent surpluses lead to what’s known as large positive net international investment positions (NIIP) – a measure of an economy’s net external wealth. And Asian majors like Japan, mainland China, Taiwan, and South Korea have outsized NIIPs, which over time should put upward pressure on their currencies. But many Asian currencies have actually been weakening in recent years. The largest ever single-day gain in the Taiwanese dollar earlier last week may not be a policy-driven move. But the timing and the size of it have led to speculation about what it might mean more broadly for other external-surplus currencies. Could significant appreciation in the likes of JPY and KRW be the next big moves in FX?

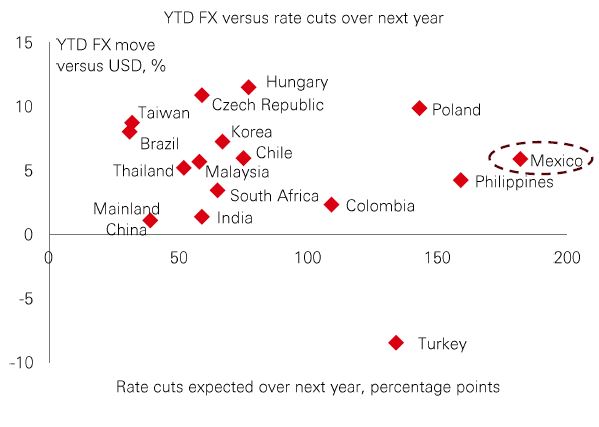

Mexico’s growth engine is stuttering amid high policy uncertainty, with a slowing US economy adding to headwinds. The previous week’s Q1 GDP data just eked out positive growth, after a big contraction in the prior quarter. But the good news is that these growth risks, combined with inflation consolidating below 4%, mean Banxico looks set to maintain its easing stance. The market is pricing in over 1.75% of cuts over the next year. Despite this, the Mexican peso has done relatively well against the US dollar this year, helping to cap inflation. This reflects Mexico’s robust macro fundamentals – including healthy fiscal and external balances, and FDI inflows amid nearshoring (which may speed up as firms leave China). |

And for those worried about tariffs, it should be remembered a big component of Mexico’s exports to the US are covered by the USMCA treaty, with negotiations underway to reduce the 25% rate for non-USCMA compliant goods. Some Mexico City-based analysts think the combination of a limited tariff impact, high real yields, significant rate cuts, and a widening domestic investor base set the stage for further strong performance of local currency government bonds.

| Still a Buffet favourite |

April saw oil prices dip below USD60/bbl for the first time since early 2021. This has come amid increasing concerns over the global demand outlook on the back of trade tensions, and some weaker US data. But OPEC+ policymaking has been a decisive factor. The cartel surprised investors in early April by announcing plans to significantly boost headline output in May. There is now speculation there could be an even higher output target for June, set to be decided next Monday. Why would OPEC+ do this now? The simple reason is that Saudi Arabia is frustrated with rising levels of non-compliance among members – with countries such as Iraq, Kazakhstan, and the UAE pumping well above their quotas. Perhaps the pain associated with a further fall in prices will force future discipline. It’s a risky strategy. But the implication is much lower oil prices than we have been used to in recent years. |

Just as 2025 inflation forecasts are being upgraded, the supply shock is welcome news for Western economies and major emerging markets such as India and China. And with inflation expectations closely tied to oil prices, the Fed has a bit more breathing space to cut rates.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg, IMF, IFS, MSCI, Datastream. Data as at 7.30am UK time 09 May 2025.

Source: HSBC Asset Management. Data as at 7.30am UK time 09 May 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Risk appetite improved amid rising optimism for a de-escalation in global trade tensions. The US dollar was stable against a basket of major currencies. US Treasury yields rose modestly after some solid economic data, including ISM services and jobless claims figures. The Fed left rates unchanged, with Chair Powell emphasising that policy remains well positioned to respond when there is further clarity how the economy evolves, while noting risks of higher unemployment and inflation. Meanwhile, the Bank of England lowered rates by 0.25%. In equity markets, US stocks traded sideways following rallies in the prior two weeks. The Euro Stoxx 50 was largely unchanged amid mixed Q1 earnings, while Japan’s Nikkei 225 gained in a holiday shortened week. Other Asian markets were broadly higher, with a new round of Chinese policy stimulus bolstering the Shanghai Composite and Hang Seng, whereas India’s Sensex softened on geopolitical uncertainties. In commodities, oil prices rebounded, and gold posted decent gains in a volatile week.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.