5 May 2025

The first 100 days of Trump 2.0 have been a rollercoaster ride in investment markets. Volatility has been driven by policy uncertainty, requiring investors to not only consider what the landing zone for tariff policy might be, but also how much damage may have already been done.

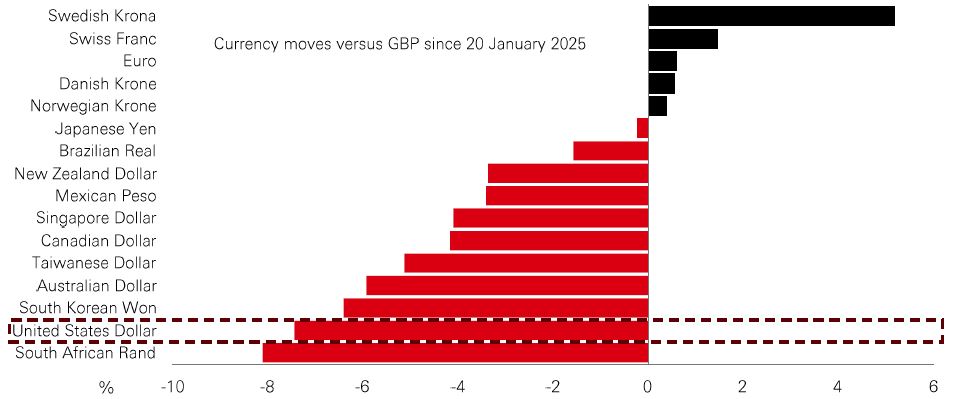

Since the president’s inauguration on 20 January, the US dollar has been the weakest G10 currency, falling by more than 7% in GBP terms. While gradual depreciation may have been a policy objective of the new administration, the depth of the correction has hastened questions about a possible end of “US exceptionalism”. And the surging gold price – up by 22% in the first 100 days – has reinforced a sense of investor uncertainty.

US stocks have been laggards too – the S&P 500 has been among the worst performing stock indexes. Meanwhile, we’ve had market correlations going haywire between stocks and bonds, and interest rates and dollar crosses.

The critical issue now is what happens next? At least part of the answer depends on how the macro facts evolve relative to what investors are currently assuming. The consensus seems to believe in a return to normal patterns, with growth and profits softening, then re-accelerating. But the problem with this is that recent trends in markets have been anything but normal and policy uncertainty is still ultra-high.

It means staying invested and preparing portfolios for continued regime uncertainty and elevated market volatility is still the right strategy. That involves more granular country, regional, and factor allocations – and integrating assets and strategies that tend to be uncorrelated to stocks, including alternatives.

A major new study by the International Energy Agency projects that electricity demand from data centres worldwide will more than double by 2030 to around 945 terawatt-hours. That’s slightly more than the entire electricity consumption of Japan today. Easily the biggest driver of this increase is AI, with power demand from AI-optimised data centres on course to quadruple by 2030. In the US – which currently accounts for around half the world’s data centres – power consumption from these facilities looks set to account for almost half the growth in electricity demand over the same period.

This intense demand growth could be potentially transformational for the electricity industry, which has seen no growth for two decades, as well as other sectors. Recent analysis by some specialists pinpoints key areas where the asset class could participate. They see opportunities in high-growth areas of the communications and energy infrastructure sectors, but among the biggest is in utilities. Here, there is a broad range of companies across all regions and markets exposed to different aspects of the data centre growth dynamic, and investment opportunities across the sector.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg. Data as at 7.30am UK time 02 May 2025.

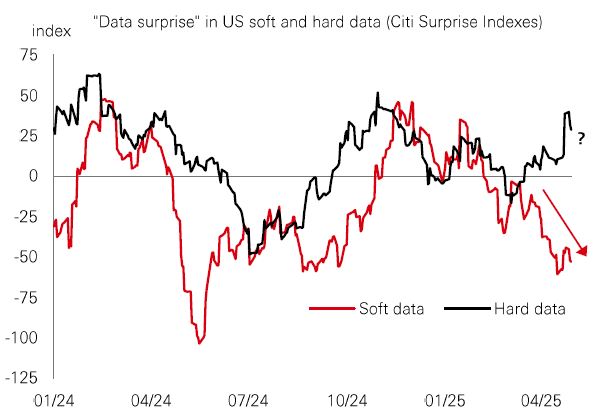

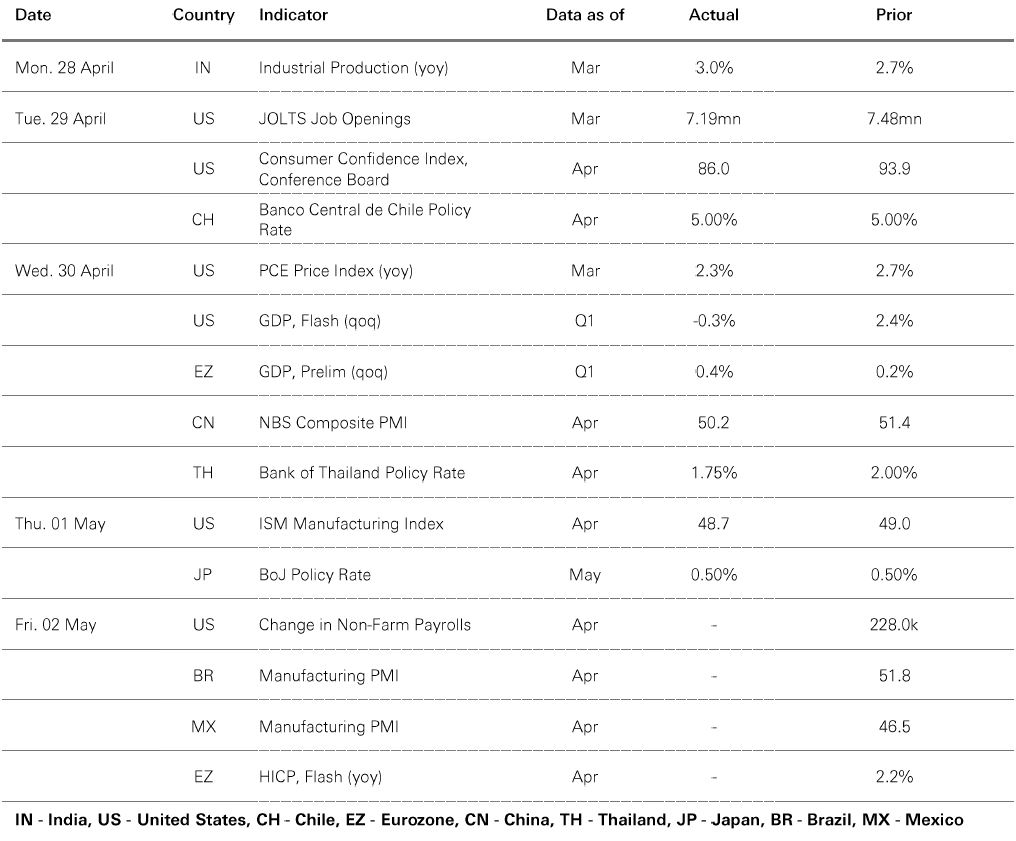

“Liberation Day” occurred on 2 April, but the latest data show the tariff threat was already affecting the US economy in Q1. Consumer spending was stronger than expected while equipment investment and inventories provided sizeable boosts to growth, as households and firms tried to get ahead of tariff-driven price rises. However, this was not enough to offset a surge in goods imports, which led GDP to contract for the first time since Q1 2022. |

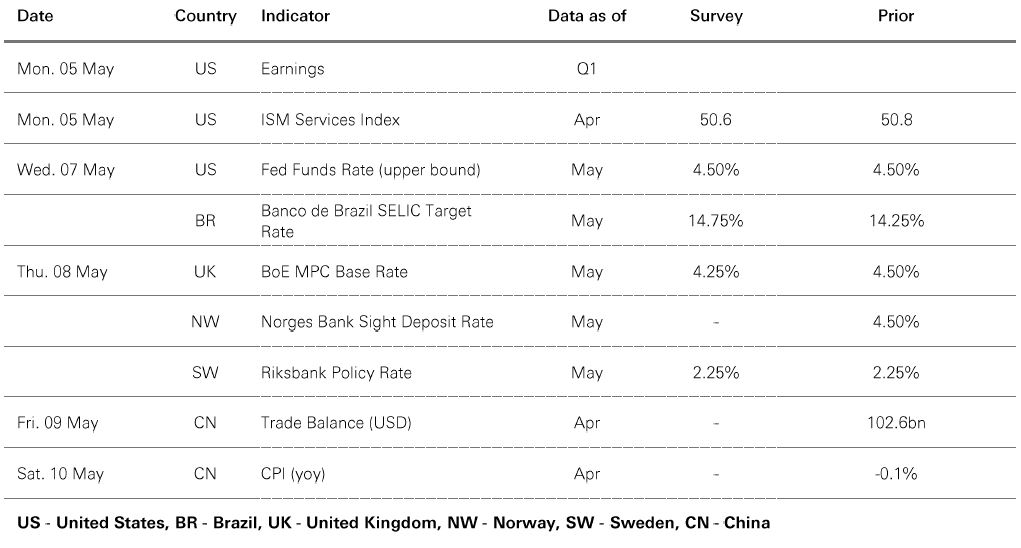

While business and consumer spending were robust in Q1 and, on most measures, the labour market continues to hold up, a swathe of surveys point to a meaningful slowdown at some point. Where does this leave the Fed ahead of its May meeting? Most likely, it will maintain a “wait and see” approach as it looks through the policy and data fog. However, one helpful development was a weak March core PCE inflation print, which suggests underlying price pressures were diminishing prior to any tariff-induced increase. Combined with well-behaved market-based inflation expectations, this should allow the FOMC to cut rates gradually from June.

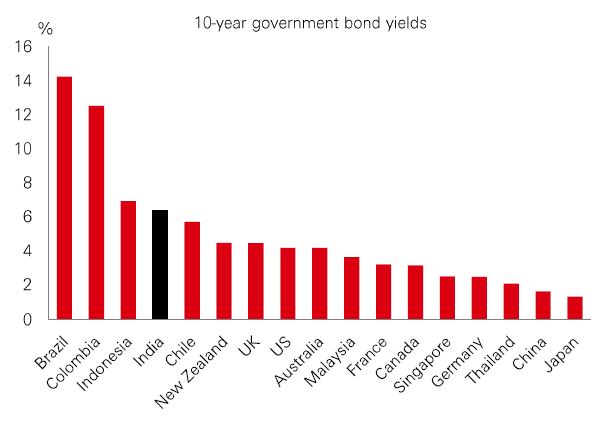

Indian fixed income returns were subdued in early 2025 as investors fretted over the country’s economic resilience to global headwinds. But that reversed sharply in March after the Reserve Bank of India finally kicked off its easing cycle. Inflation is now well within the central bank’s 4% target range, and expected to remain in retreat. For global allocators, higher real yields have been a key attraction of Indian bonds – but there are other catalysts at play too. |

The main one, of course, is that the domestic orientation of India’s economy is a key advantage. It makes Indian assets less sensitive to shifts in global risk sentiment, and so a potentially attractive way to diversify global portfolios. Technical factors are also playing a role. Moves by the RBI to improve market liquidity, and the government’s pursuit of fiscal consolidation should be positive for bond supply-demand dynamics. And India’s strong FX reserve buffers help to counter volatility in capital flows and cushion currency volatility. Meanwhile, inclusion in global government bond indices, including GBI-EM and, later this year, FTSE, are also expected to grow global interest – and is a further potential reason for including India fixed income in a strategic allocation.

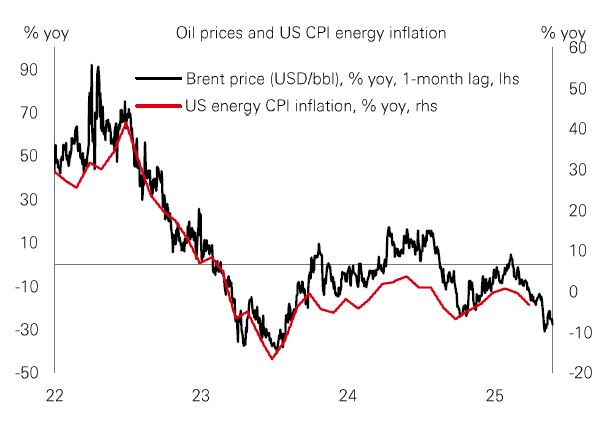

April saw oil prices dip below USD60/bbl for the first time since early 2021. This has come amid increasing concerns over the global demand outlook on the back of trade tensions, and some weaker US data. But OPEC+ policymaking has been a decisive factor. The cartel surprised investors in early April by announcing plans to significantly boost headline output in May. There is now speculation there could be an even higher output target for June, set to be decided next Monday. Why would OPEC+ do this now? The simple reason is that Saudi Arabia is frustrated with rising levels of non-compliance among members – with countries such as Iraq, Kazakhstan, and the UAE pumping well above their quotas. Perhaps the pain associated with a further fall in prices will force future discipline. It’s a risky strategy. But the implication is much lower oil prices than we have been used to in recent years. |

Just as 2025 inflation forecasts are being upgraded, the supply shock is welcome news for Western economies and major emerging markets such as India and China. And with inflation expectations closely tied to oil prices, the Fed has a bit more breathing space to cut rates.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 02 May 2025.

Source: HSBC Asset Management. Data as at 7.30am UK time 02 May 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Risk markets were mixed as investors assessed Q1 corporate earnings, macro data and ongoing global trade developments. US Q1 GDP contracted on a surge in imports, though the ISM manufacturing index declined less than anticipated, ahead of April’s non-farm payrolls data. The US dollar index further rebounded, while core government bonds edged higher. US and European credit spreads widened modestly after two weeks of narrowing. In stock markets, US indices broadly gained, as tech stocks led the rallies on some positive earnings. European markets mostly advanced, driven by strong Q1 results in the financial and defence sectors. Japan’s Nikkei 225 rose as dovish BoJ comments weighed on the yen, boosting export-oriented stocks. Other Asian markets, including Hong Kong’s Hang Seng and India’s Sensex, recorded gains, though the Shanghai Composite closed slightly lower ahead of Labour Day holidays. In commodities, oil prices fell amid concerns over a weaker demand outlook, while gold extended its recent consolidation.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.