2 May 2025

Jonathan Sparks

Chief Investment Officer, UK, HSBC Global Private Banking and Wealth

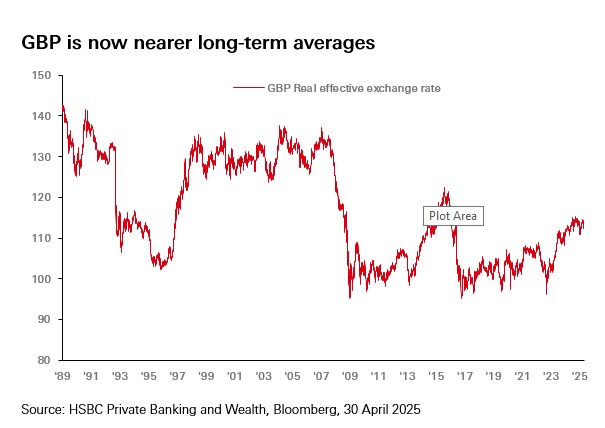

Since mid-January GBP has climbed almost 10% against the USD. In the heavyweight currency markets of the UK and US, this is quite a feat.

With the broad USD down about 9% over this period and GBP just under 3% weaker against the Euro it is apparent that the GBP’s strength is largely because of USD weakness. It’s not hard to reason why: the US was riding a wave of “exceptionalism” in economic growth and AI-led innovation.

Now this exceptionalism has been called into question, there is a concern that the tide could start to turn on the USD. Arguably, it already has and any further strength to GBP is likely to come more from USD weakness then GBP strength. This is because GBP is already relatively strong, and we don’t expect it to gain any more against the Euro.

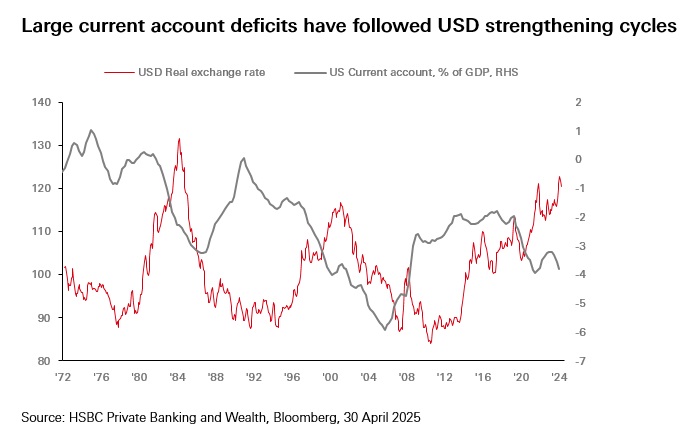

History gives us some perspective on the USD from here. From the low in 2011, the real USD strengthened by 46% to its peak early this year – the real USD accounts for the purchasing power of the USD. This chimes with the 50% rise on the late-70s and early-80s, albeit the recent rise has been over a longer period. During the 80s, when the USD started to fall, it plummeted. This is down to a coordinated effort agreed by the Plaza Accord.

Today there are parallels with the early-80s. Most notably, in both cases the US has a current account deficit of more the 3% of GDP, which comes as no surprise given that a strong US makes foreign goods cheaper. In both cases this led to political pressure. However, this time a broad global consensus to sell USD and restructure trade looks less within reach while central banks are more independent and strictly aligned around inflation targeting.

With this in mind, an extended structural decline in the USD is not our base case, but the risk is tilted towards more downside as the debate over the desire for a weaker USD rolls on. It also means that there could be more volatility ahead for GBP. The priority should therefore be to diversify risk and take stock of potential mismatched currency asset and liabilities. For example, if earnings were in USD but taxes in GBP, it would be prudent to weigh up potential currency risk.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal. This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.