16 May 2025

Jonathan Sparks

Chief Investment Officer, UK, HSBC Global Private Banking and Wealth

The UK economy started 2025 on a surprisingly strong note. GDP rose 0.2% month-on-month in March, and Q1 growth came in at 0.7% quarter-on-quarter, comfortably ahead of expectations. A large part of the lift came from business investment, particularly in transport equipment and IT, which helped power the rebound after a sluggish end to 2024. But we’re not jumping to conclusions. For us, this feels more like a strong first lap than a sustained pace of growth.

Consumer confidence is still the elephant in the room. We’re encouraged by the improvement in business sentiment and the investment rebound, as it suggests companies are willing to spend again. But at the same time, we’re closely watching the consumer side because in the UK, if the consumer is doing well, the economy follows. Here, the picture is much softer. Household consumption barely grew in Q1, and consumer confidence actually fell in April to its lowest level this year, according to GfK data. Retail activity is still below pre-pandemic levels too. This tells us that despite stronger real wages and easing inflation, UK households remain cautious. Even with inflation falling and the labour market holding up reasonably well, that confidence just hasn’t translated into stronger spending. Perhaps news of trade deals, stronger growth, and rate cuts, can awaken some animal spirits. Consumer confidence is, with the exception of the labour market, the survey to watch.

On the face of it, the labour market is more mixed. Really this is because of the resilience of the year-in-year wage growth, which is more driven by the rise in the National Living Wage than a hot labour market.

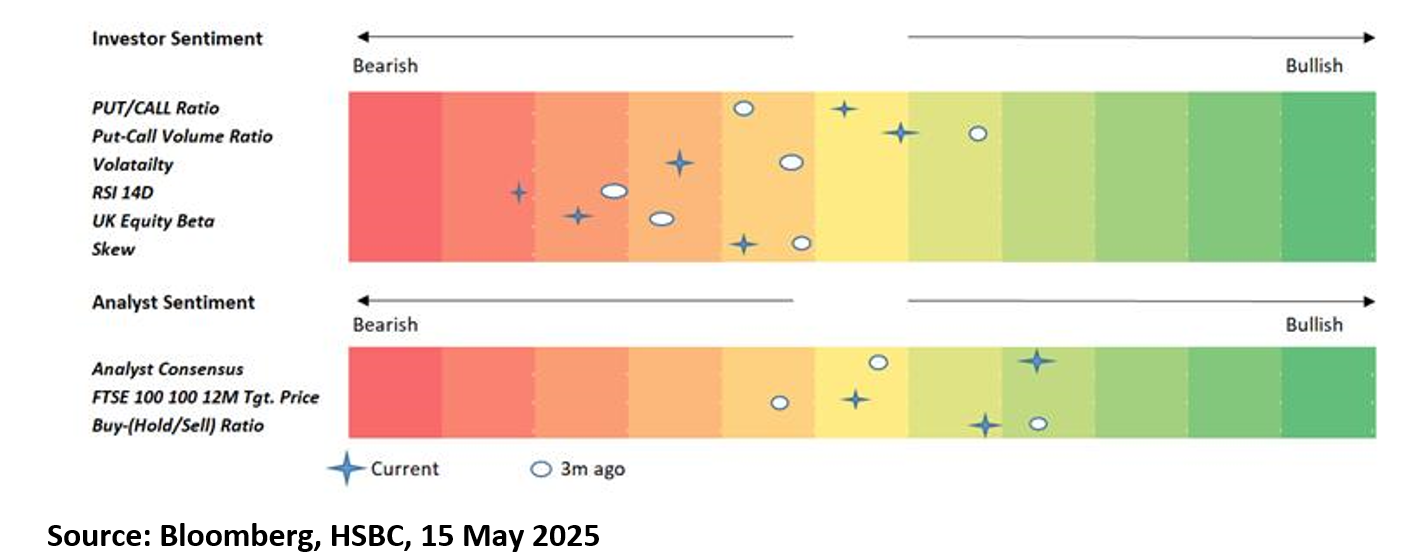

We say neutral on UK equities: Despite the solid Q1 data, we’re holding our neutral stance on UK equities. A big chunk of the Q1 strength came from investment, and some of that looks like it may have been front-loaded or driven by one-off factors (like aircraft imports). To become more positive, we’d like to see the consumer brighten up for a reason to favour the more commodity driven sectors that take up a large share of the FTSE 100. With equity valuations not especially cheap and sentiment already recovering, we don’t see a compelling reason to shift overweight right now.

UK Gilts look more compelling: Where we do see opportunity is in UK gilts. Real yields on 5–10-year gilts are now close to 2%, which is attractive in a world where inflation is cooling, and central banks are starting to think about easing. If the BoE brings the base rate down to our expected 3% level by mid-2026—versus current market pricing closer to 3.5%—there’s meaningful potential for capital gains.

One positive observation we have picked up on, is the modest bounce in analyst sentiment. And, by the way, this isn’t constrained to the UK – we’ve seen it in the US too. As President Trump has walked back on tariffs, analysts are in turn walking back on some of their more bearish forecasts. This had led to a bounce in riskier assets, such as equities; and that could be sustained over the next few weeks. That’s why the US equity market is looking a lot more appealing again, and this week we took the decision to compliment our low risk UK strategy with higher risk US equities.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal. This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.