The rising cost of living

Energy, food and living costs have been going up. Here, you'll find ideas on how to cut back on spending and ways to reduce the stress.

Dealing with the rising cost of living

If you’re worried about your budget being squeezed by higher household bills and other everyday costs, have a look at our article to understand:

1. Why living costs are rising

2. How to cope with higher living costs

3. Where to get support if you’re struggling

If you've missed a bill or payment, or think you might, it's important you let us know as soon as possible. We may be able to offer you support and help you better manage your finances.

Read our guides to help reduce debts and start saving so you can take control of your finances.

How does the cost of living affect my finances?

As everyday household budgets continue to be squeezed, we look at practical steps you could take to try to ease the pressure on your own finances.

If you're worried about rising interest rates, here are some ways you might be able to reduce your mortgage payments.

It's tempting to think about cancelling your insurance to save money. But before you make a decision, here are a few factors worth considering.

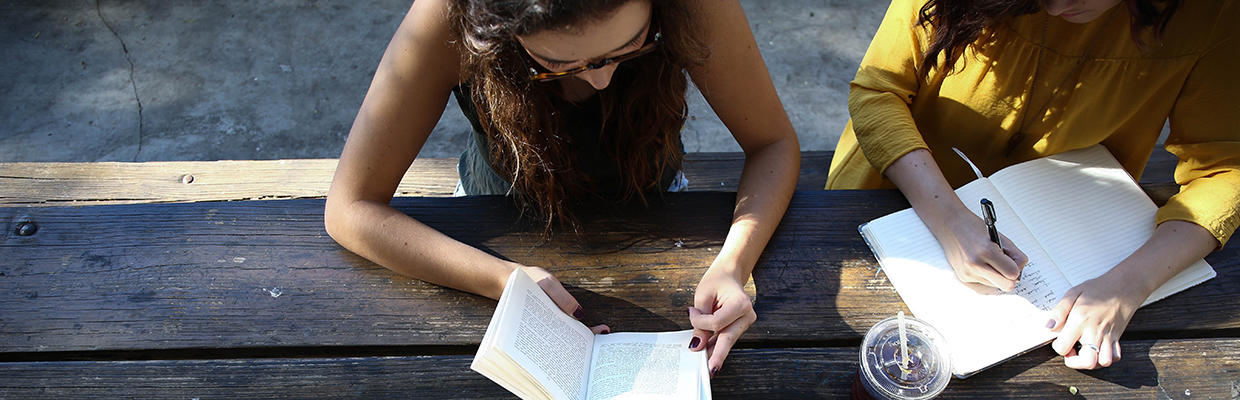

Here, we share insights into how students have been affected by the rising cost of living, plus tips to help you manage your money and get support if you need it.

Ways to cut your spending

As the cost of living goes up, reducing your spending could help you to make ends meet. We've picked some areas where you may be able to cut back or find a cheaper alternative.

For many households, food shopping is among the biggest weekly expenses. See how you can save money and waste less.

If you’re looking to cut back on your spending, things like streaming and gym subscriptions can be a good place to start.

One of the first steps towards managing your money effectively is to understand the way you’re spending.

How does this affect me?

Higher prices are affecting us all. Here, we look at how the state of the economy has an impact on everyday household budgets - and ways you might be able to ease the pressure.

Billions of pounds of government benefits and allowances go unclaimed every year because many people don't realise they qualify for them.

Check how recent Government announcements on personal finances could affect you.

Whether you’re a borrower or a saver, interest rates will have an impact on you and your money.

Find out what a change to the Bank of England base rate could mean for you.

How to relieve your financial anxiety

More and more of us are feeling the strain as a result of the rising cost of living. Here are some tips to help you cope with financial anxiety.

Talking about money can take a weight off your mind and help you move forward. Here, we look at the benefits of talking about money and how to start the conversation.

If you’re feeling anxious about your finances, you’re not alone. Find out how we can help.

Tools to help you

Take control of your spending with our budget planner calculator. It’ll help you work out where your money goes and see if you can start saving more.

Register for one of our free webinars on everything from budgeting to making the most of your money or one of our specific cost of living webinars.

Our financial health specialists are available to speak to you about your banking and financial needs.

Use our money management tools to stay on track of spending and help make the most of your money.

Need help paying your energy bills?

If you're struggling to pay your energy bills, the best thing to do is contact your supplier as soon as you can. Here are some handy links outlining help you can get from some of the UK's biggest gas and electricity providers.

If your energy company isn't here, please visit their website to see what support they can offer.

If your energy company isn't here, please visit their website to see what support they can offer.

Explore more

Check out these helpful tips, including planning a budget and making good financial decisions.

Getting your finances in shape can make a big difference to your wellbeing. Check out our guides and tools to help you make your financial fitness plan.

Check your financial fitness score and get your money in shape.