16 February 2026

With Lunar New Year celebrations getting under way, 2026 marks the Year of the Fire Horse, signifying optimism, high energy, strength, and rapid progress – all traits that have featured heavily in Asian markets recently.

Last year, Asia Pacific stocks (ex Japan) delivered a 32% gain in USD terms – their best annual performance since 2017. That was despite trade and geopolitical tensions, and global policy uncertainty. A weaker US dollar helped, as did lower-than-feared effective tariff rates, and a US-China trade truce. But this year, the region’s solid underlying fundamentals are taking centre stage. Macro reforms and derisked economies provide a strong structural backdrop. Meanwhile, the outlook for GDP and corporate profits looks positive, domestic demand has been resilient, and there has been progress on regional trade integration.

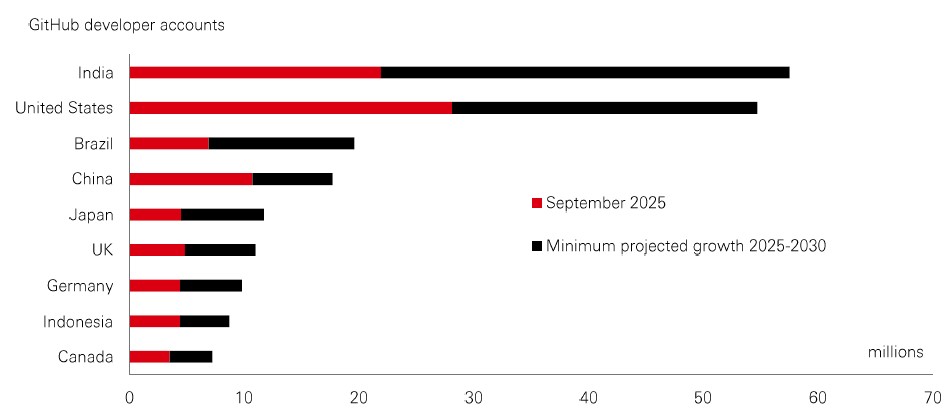

Another factor is Asia’s role in the tech and AI supercycle. It is dominant in semiconductor manufacturing, particularly in Taiwan and South Korea, as well as software development – Asian countries are among the strongest global contributors to the GitHub code repository. India and southeast Asian economies, especially Singapore, Malaysia and Vietnam, are also part of the AI value chain, from assembly to data centres. And mainland China's tech innovation appears poised for strong policy-driven growth this year, with AI at the centre of the country’s economic and industrial plans, along with a focus on sectors like EVs, green energy, and advanced manufacturing.

The outlook for Asia’s stocks is constructive, with markets offering a less expensive play on the AI trade, as well as broad sector diversification, and high-quality growth opportunities. This should help the global broadening out of market leadership to continue. Kung Hei Fat Choi!

Asia has traditionally been seen by many global investors as a single homogenous bloc, with asset class returns that tended to magnify global trends. In part, that was true. Over the past decade, drivers like US monetary policy, China’s investment cycle, global trade, and commodities markets had a habit of causing Asian markets to move together. In periods of growth, that wasn’t a problem. But when markets were stressed, asset correlations spiked, and any hope of achieving diversification from exposure to the region slipped away.

But this is changing. Areas like domestic monetary and fiscal policy, regulatory divergence, domestic inflation trends, and the effects of China’s structural slowdown have all weakened the conventional market drivers that kept Asian asset returns moving together. And so, the generalised view of Asian market returns now risks missing some important nuance. While China is still the biggest influence on returns and volatility across the region, local markets now have much clearer idiosyncratic drivers.

The takeaway for investors is that a selective approach to local asset allocation in Asia can potentially deliver more diversified exposure, and ultimately more resilient portfolios.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg, Macrobond, GitHub Octoverse. Data as at 7.30am UK time 13 February 2026.

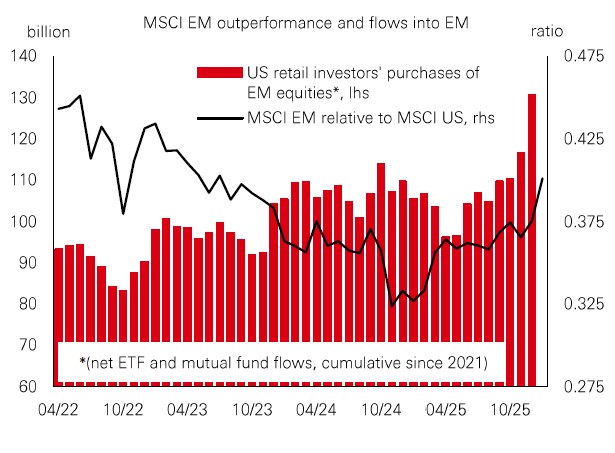

It has been hard to miss the outperformance of emerging market stocks versus the US recently. When you look under the bonnet, there are signs that investors are reallocating away from concentrated US exposure to regions with potentially more balanced growth and better diversification. This is increasingly evident in portfolio flows. Indeed, US retail investors’ purchases of EM stocks have been rising since the middle of last year. Given that EM is coming from a lower base, even a modest reallocation from the US to EM can potentially drive outsized performance. |

Fresh dollar weakness in January and the prospect of US monetary easing are catalysing investor interest in EM assets. Valuations remain supportive: EM equities trade at a discount to developed markets, and real yields in many EM bond markets remain compelling relative to history. Plus, fundamentals are improving, with profits momentum strengthening across large parts of Asia and Latin America, helped by resilient domestic demand, easing inflation, and robust global trade. Taken together, recent trends in portfolio flows point to EM assets as beneficiaries of an evolving global macro and capital allocation regime.

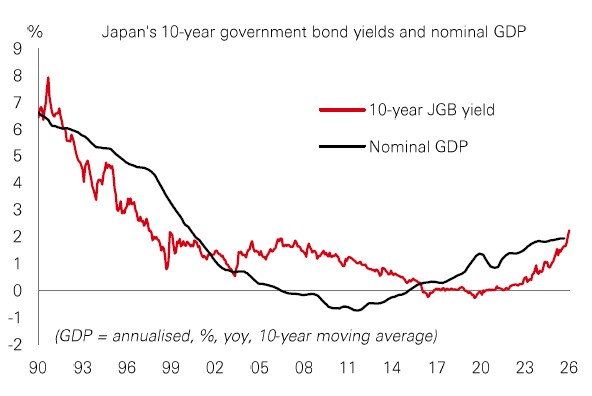

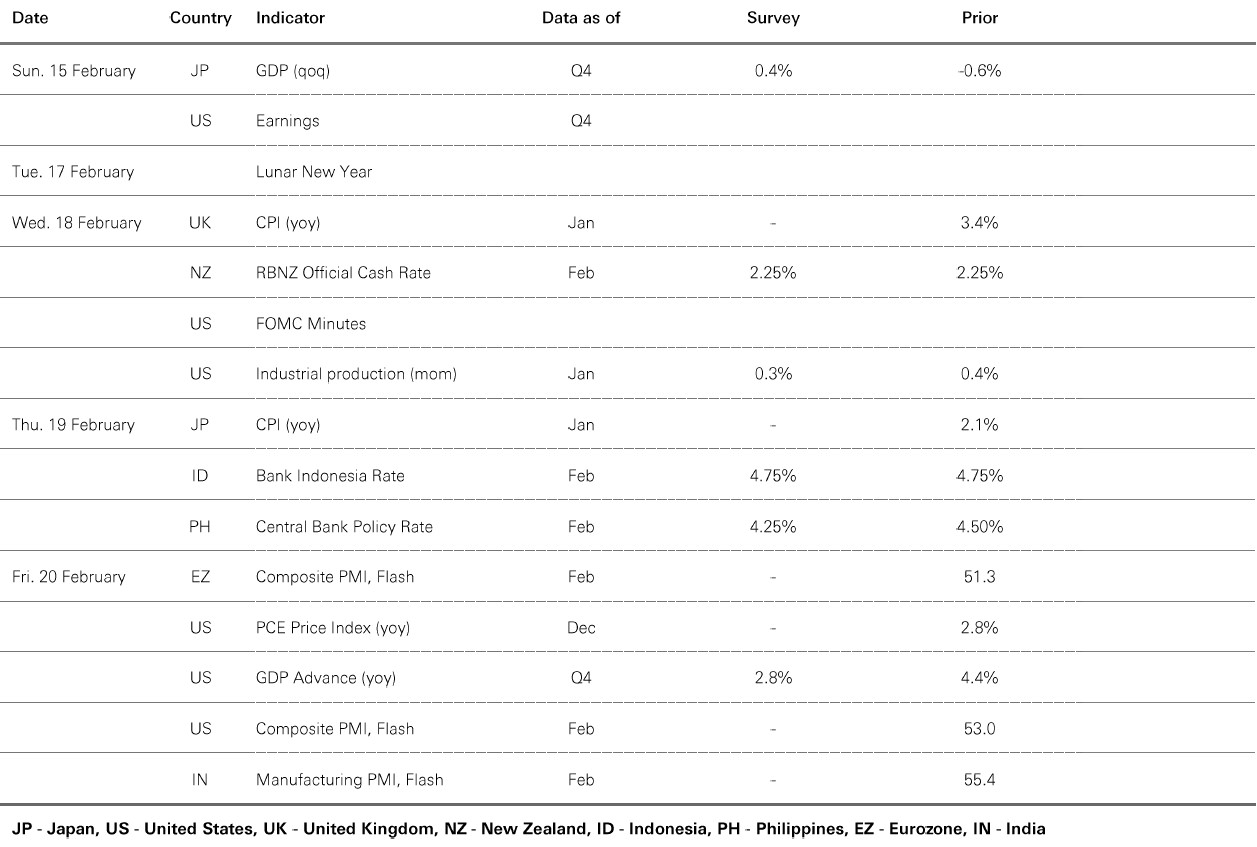

Valentine’s Day in Japan is a decidedly chocolate-y affair. For now, the nation’s affections lie with PM Sanae Takaichi, who sweetened voters with a pro-growth agenda, and won their hearts in a landslide election earlier this month. In response, stocks soared. Takaichi’s plans to hike spending in areas like AI, defence, and energy, arguably bode well for higher productivity and medium-term growth – and the market liked the prospect of stability after her resounding win for the LDP party. While Japanese stock valuations have risen recently, an improving 2026 earnings outlook and ongoing structural reforms (including share buybacks and rising shareholder returns) support a positive view of the country’s stocks. |

Meanwhile, Japan’s bond market and the yen also reacted positively. Real yields remain modest and stronger domestic growth should help with debt sustainability. But there are still risks. Takaichi’s aggressive plans for pro-growth fiscal stimulus could put further pressure on already stretched public finances. And if that happens, the relationship between her and the bond vigilantes could sour.

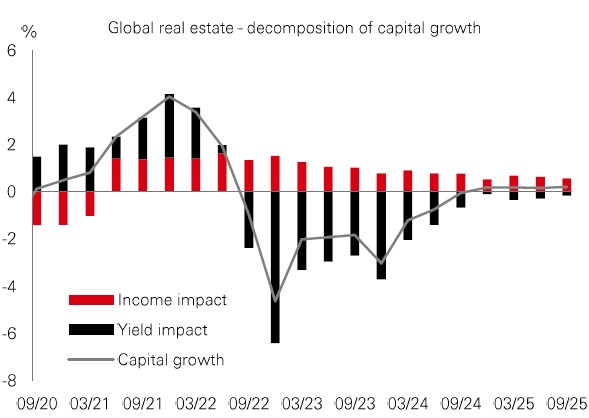

According to US census data, 10,000 people turn 80-years-old every day in the US, with similar trends across developed markets. One asset class that appears well-positioned to capitalise on that is real estate. Senior housing counts among the most keenly-watched sub-sectors in property – rubbing shoulders with AI data centres, office markets in London, New York, and Tokyo, and the world’s best retail destinations. |

This comes as global real estate markets continues to see signs of improvement. Despite macro headwinds – including sluggish developed world labour markets and above-target inflation – leasing data show occupier sentiment is holding up well, especially in the office and retail sectors. With overall capital growth now positive for five consecutive quarters, some sector specialists see an improved outlook, with the office and retail sectors – as well as senior housing – on an upward curve. That is being driven by stable (and growing) cashflows and improving occupier fundamentals – supporting the view that real estate offers bond-like characteristics and the potential for relatively low volatility in investment portfolios.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Costs may vary with fluctuations in the exchange rate. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 13 February 2026.

Source: HSBC Asset Management. Data as at 7.30am UK time 13 February 2026. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

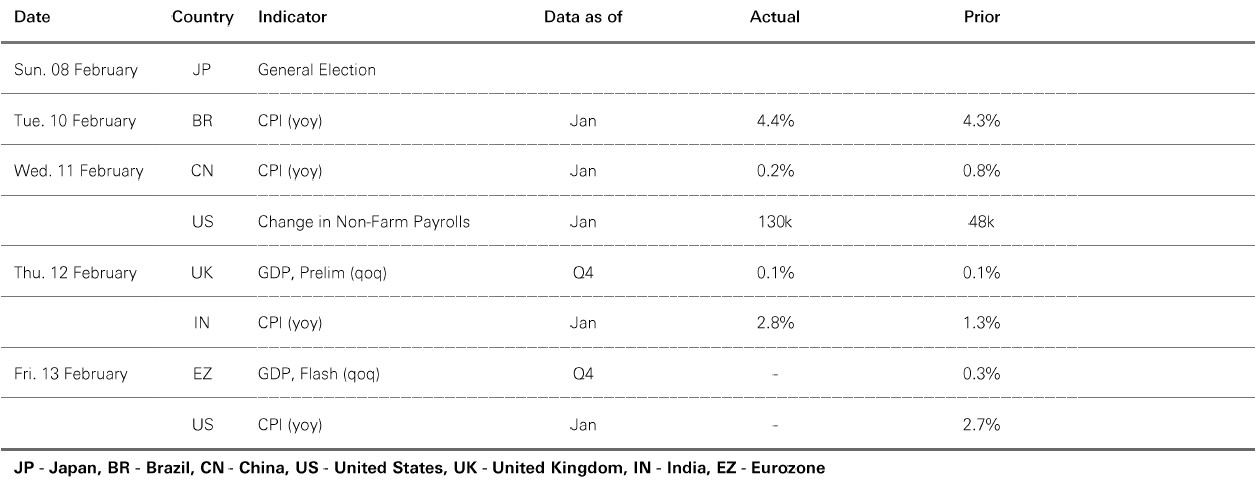

Global equities saw broad-based gains, supported by a robust US employment report, and with US Q4 earnings season drawing to a close. US tech stocks rebounded amid continued volatile trading in some software names, with defensive sectors and value faring better. In Asia, Nikkei 225 touched an all-time high following the LDP’s landslide victory in a snap general election. Ahead of the Lunar New Year holidays, the tech-driven Kospi index rallied, with Shanghai Composite and Sensex indices also on course to post modest rises. In Europe, the Euro Stoxx 50 and FTSE100 indices reached fresh highs. Latin American equities also continued to perform well. The US dollar fell against major currencies despite a re-pricing of US rate expectations. Two-year US Treasury yields rose while 10-year yields declined modestly. In commodities, oil and gold were both higher.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.