23 July 2025

Most investors want to time the market in the hope that they can buy low and sell high to maximise investment returns. However, in reality, nobody can predict the best time to invest. While history can’t tell you when these periods will occur, it does show that financial markets eventually recover from even the most turbulent times. The ability to ride out short-term fluctuations and stay invested for the longer term tends to bring positive returns over time.

Investors who try to time the market aim to outperform by looking for the lowest or highest point in the market cycle. On the other hand, those who spend “time in the market” are investors who focus on the fundamentals of the investment and hold it for the longer term. If you prefer investing to speculating, you should avoid trying to time the market!

Chart 1 shows what happened to £1,000 invested in global stocks at the monthly low or high, every month since January 2004. Whether investing at the monthly low or high, it does not create a significant difference in the end value.

Source: Bloomberg, HSBC Asset Management. Investing = MSCI AWCI Net Return Index, 1 January 2004 to 31 December 2024. Past performance is no guarantee of future returns.

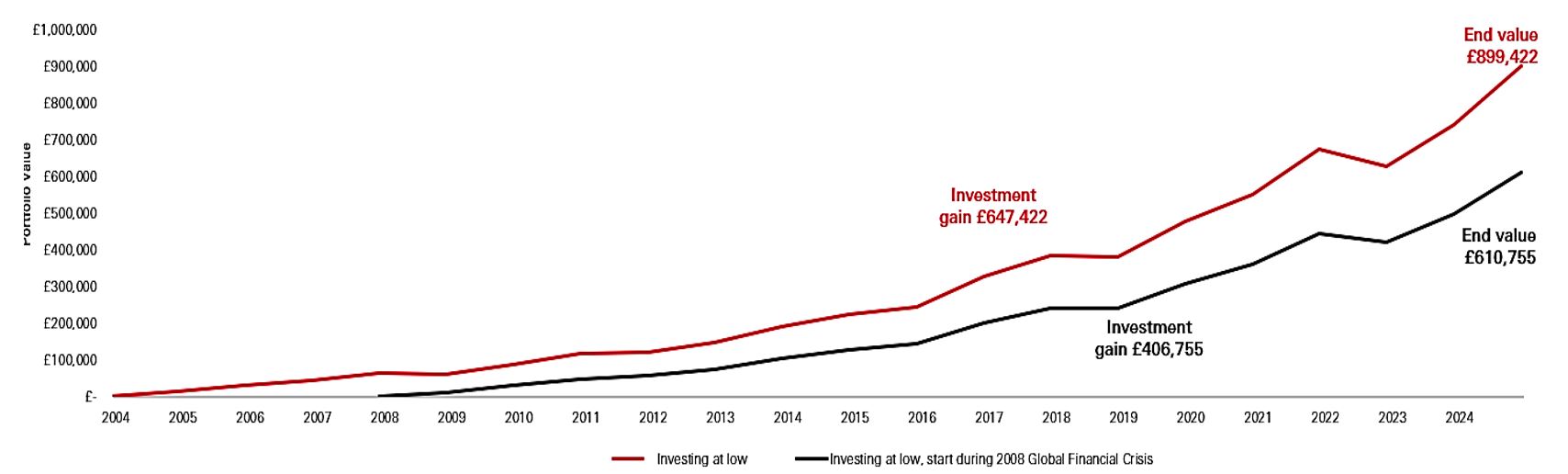

Now the black line represents an investor that waited for a big market drop to start investing. Even though this investor has impeccable timing to not only invest at the monthly low, but start during a market crash when asset values were particularly low, the end outcome is much worse.

Starting earlier (red line) meant investing £48,000 more over this time, but created an extra £288,667 in the end value – this is the power of compounding.

Source: Source: Bloomberg, HSBC Asset Management. Investing = MSCI AWCI Net Return Index, 1 January 2004 to 31 December 2024. Past performance is no guarantee of future returns.

If your aim is to grow your savings over the long term, starting to invest sooner, rather than later, is usually more important than whether you are investing at low or high points in financial markets. The longer the investment period, the greater the compounding or snowball effect. Reinvesting your earnings allows your original investment to continue growing along with the money generated by your investment.

Moreover, in trying to time the market, you run the risk of missing out on some of the best performing days. Even missing just a few of those best performing days can result in a big difference in your return.

Chart 3 shows £100,000 invested in stocks since 2005. Missing the top 20 days reduced the end investment value from around £740,900 to £279,600.

Source: Bloomberg, HSBC Asset Management. Returns are for developed market stocks - MSCI World Daily Total Return Gross World Index, as at 31 December 2024. Past performance is no guarantee of future returns.

If you are nervous about investing a lump sum, you can split the amount and make regular investments. Regular investing helps smooth out the effects and fear of market movements. More shares are purchased when prices are lower, and less shares are purchased when prices are higher. This approach can help you stay with an investment plan by reducing the impact of short-term market movements on your portfolio.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal. This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.